Search our articles

CBAM – What is it and what are the implications for global trade?

Key Insights:

- What is happening: The European Union’s Carbon Border Adjustment Mechanism (CBAM) entered into force on October 1, 2023. It is the world’s first-ever effort to introduce taxes on carbon-intensive imports.

- Why it matters: The EU hopes CBAM will reduce global emissions by incentivizing companies to source from low-emissions suppliers and by encouraging other countries to adopt climate mitigation policies. CBAM is also intended to improve EU competitiveness and slow offshoring.

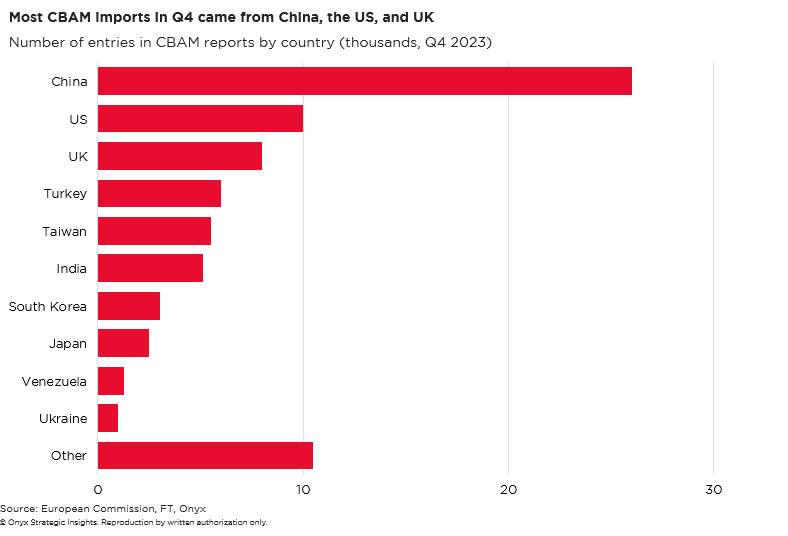

- What happens next: CBAM may only achieve some EU goals. The policy will likely curb imports of carbon-intensive products from high-emissions countries like China, India, and Turkey. But CBAM may hurt Europe’s export competitiveness. In addition to ensuring CBAM compliance, multinational firms should look out for new carbon tariffs from other countries.

ANALYSIS

How CBAM works

Origins: CBAM originated with the European Green Deal, a set of policies aimed at making the EU carbon neutral by 2050. CBAM is complementary to the EU’s Emissions Trading System (ETS), which imposes costs on European manufacturers for exceeding emissions quotas. CBAM is designed to level the playing field by taxing high-emissions products entering the single market and preventing carbon leakage – an increase in global emissions caused by offshoring to high-emissions countries.

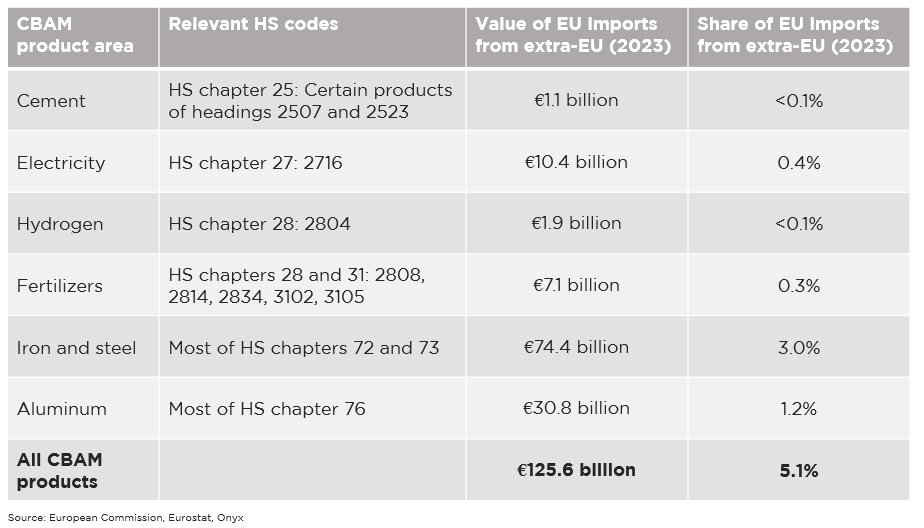

Affected products: Until 2030, CBAM will apply only to cement, electricity, hydrogen, fertilizers, iron and steel, and aluminum. Additional products will then be phased in, including oil, glass, ceramics, paper products, organic chemicals and other metals. The exact list of products covered after 2030 has yet to be determined.

Requirements: In the Transitional Phase – October 2023 to January 2026 – importers must report their CBAM imports to the EU, without paying any fees. However, the reporting requirements alone pose costs: importers must indicate the direct and indirect emissions for all CBAM products and the carbon price in the country of origin – a fact-finding challenge. Fees begin with the Definitive Regime on January 1, 2026.

CBAM Impacts

Exporters to the EU: CBAM will raise costs of exporting high-emissions products to the EU. The most negatively impacted countries are those that export heavily to the EU, have high-emissions manufacturing, and a low (or non-existent) domestic carbon price. The World Bank’s CBAM Exposure Index finds the most-impacted countries include Russia, Ukraine, Kazakhstan, India, Egypt, and South Africa. China, Vietnam, and Turkey will likely see a minor hit to their exports. Companies in Europe relying on inputs from these geographies may see their input costs rise in the coming years.

Impacts on EU manufacturing: CBAM is intended to improve the EU’s competitiveness. By raising the cost of imports from high-emissions producers, sourcing from European producers will become more attractive. However, CBAM may hurt EU exports. As inputs of high-emissions products become more expensive, Europe’s downstream producers will face higher costs and will likely raise selling prices. The hit to Europe’s trade position is concerning, but the net impact is small: most economic studies estimate just a 0.1-0.2% decline from EU baseline GDP over the long term.

Looking ahead

CBAM spreads: Other countries are watching CBAM to assess the impacts on their economies. Some have already considered adopting their own border carbon adjustment to align standards with the EU and reduce carbon leakage. The United Kingdom has approved a CBAM which mirrors the EU’s and will come into force in 2027. Canada and Australia are likewise considering their own carbon tariffs.

Trade and climate meet geopolitics: CBAM will likely facilitate the creation of multilateral blocs linking trade and sustainability. EU officials have expressed interest in assembling “climate clubs” of like-minded countries with strong climate mitigation policies. The G7 climate club marks an early effort. These multilateral blocs will often parallel geopolitical alignments. Countries looking to copy CBAM tend to be richer economies and strong allies of the EU. In contrast, geopolitically distant countries like China, India, and South Africa have threatened to challenge CBAM at the World Trade Organization. CBAM’s opponents could also retaliate directly with tariffs on EU imports.

Written by Onyx Strategic Insights