Search our articles

January macro data in line with outlook but caution signs emerge

Key Insights:

- Federal Reserve: Held interest rates steady, as widely expected.

- Q4 2024 GDP: Economic growth showed signs of slowing but remained robust at 2.3% annualized. Consumer spending was the primary driver, increasing by 4.2%, while private fixed investment contracted by 5.6%.

- December Core PCE Price Index: The Fed's preferred inflation gauge rose 0.2% from November and 2.8% year-over-year.

- December Real Disposable Personal Income: Increased by a modest 0.1% for the second consecutive month. The personal savings rate fell to 3.8%, the lowest level since 2022.

ANALYSIS

These end-of-year figures set the stage for growth in 2025, and this data generally aligns with Onyx’s base case forecast, which assumes no major policy changes. Our “business as usual” projection for the US economy includes:

- 2.3% real GDP growth

- Core inflation trending down to approximately 2.5% by year-end

- Three Fed interest rate cuts, lowering the target range from 4.25-4.50% to 3.50-3.75%

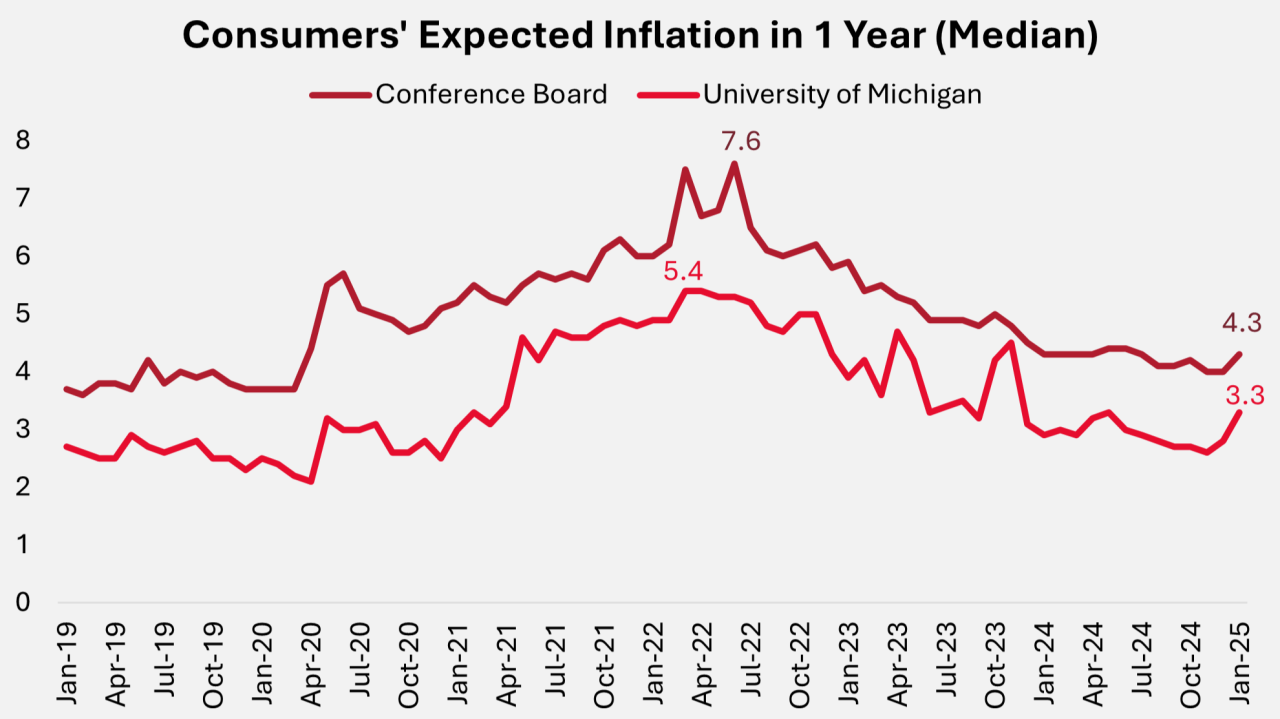

However, US policy will play a large role in how the economy performs this year. In that vein, somewhat lost among the headline data releases were two consumer sentiment surveys. The Conference Board Consumer Confidence survey and the University of Michigan Survey of Consumers, revealed that post-election consumer confidence is waning. More concerningly, inflation expectations are rising. The Conference Board reported a rise in the median 1-year ahead inflation expectations from 4.0% in December to 4.3% in January, while the University of Michigan survey showed an increase from 2.8% to 3.3% over the same period.

“this jump in inflation expectations is the first significant movement in about a year and may reflect consumers' concerns about the impact of potential tariffs.”

—

Consumer sentiment figures are closely watched because they can become self-fulfilling. When consumers anticipate rising prices, they may accelerate purchases (perhaps as evidenced by the Q4 consumer spending acceleration and declining savings rate), boosting economic activity and putting upward pressure on prices, thus validating those expectations. Some studies also suggest higher inflation expectations can impact wages.

While it's important not to overreact to a single month's data, this jump in inflation expectations is the first significant movement in about a year and may reflect consumers' concerns about the impact of potential tariffs. Interestingly, the 0.3 to 0.5 percentage point increase in inflation expectations aligns with Onyx's modeling of 25% tariffs on imports from Canada and Mexico and 10% on imports from China. We'll find out what happens with tariffs over the weekend and discuss the implications at our webinar next week.

Topics: North America, Economy

Written by Onyx Strategic Insights