Search our articles

Southeast Asia Attracts Investment but Faces Capacity Crunch

Key Insights:

- What is happening: Investment is shifting from China towards Southeast Asia-5 (SEA-5) countries; however, the increased investment is putting pressure on the region's manufacturing capacity by tightening labor markets and potentially fueling inflation.

- Why it matters: One of the ways that SEA-5 nations seek to address existing labor shortages challenges is by increasing productivity. The successful execution of this strategy will be crucial for sustaining their competitiveness in the global market.

- What happens next: As the SEA-5 confronts obstacles in enhancing labor productivity, they reinforce it with industry specialization to alleviate capacity constraints. Future policies within these countries are set to prioritize this crucial aspect.

ANALYSIS

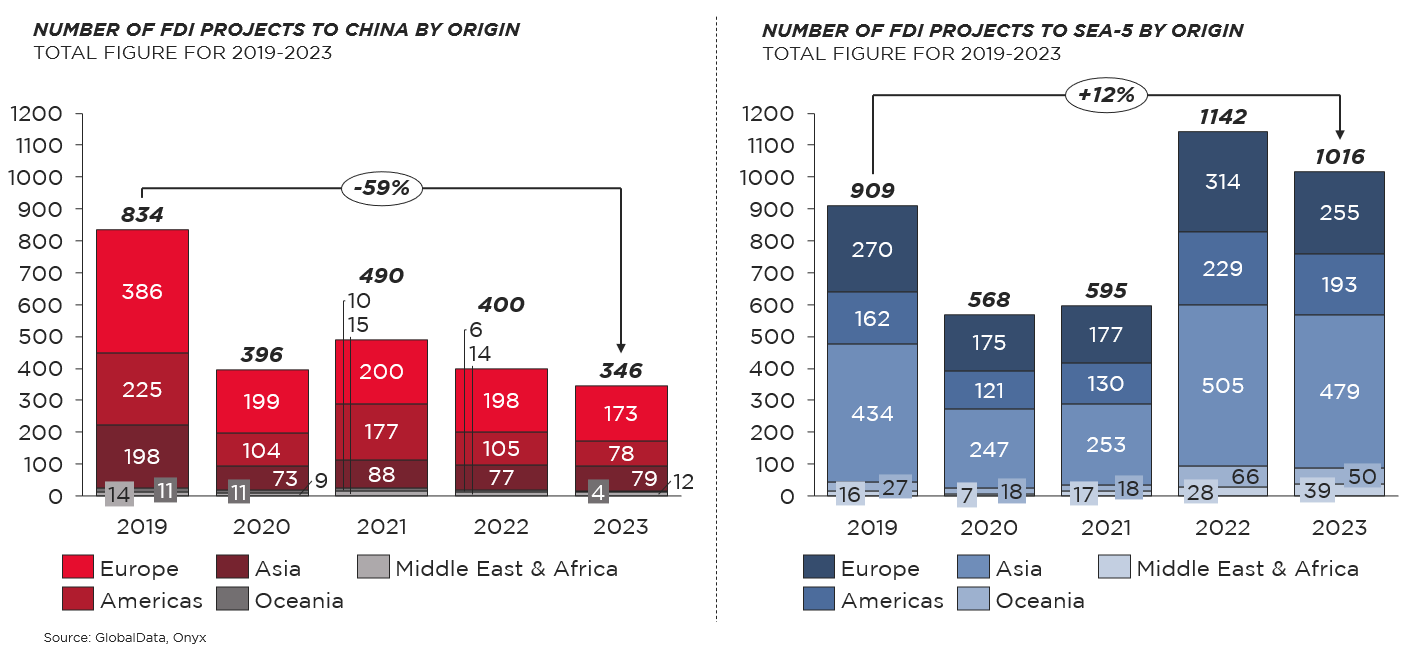

Increasing investment in Southeast Asia-5 (SEA-5) raises capacity concerns

Several drivers – notably escalating geopolitical tensions between China and the US and EU – are compelling businesses to diversify their supply chains. This change is clearly reflected in the foreign direct investment (FDI) data as project counts dropped in 2020 and have remained persistently low at less than 60% of 2019 levels. Meanwhile, Southeast Asia-5 nations – Indonesia, Malaysia, Philippines, Thailand, and Vietnam – have seen a surge in projects. Despite boasting a working-age population only a third of the size of China, the bloc has attracted nearly three times the projects in 2023 and topped the manufacturing-haven’s pre-COVID project counts.

The surge in investment flowing into SEA-5 nations is resulting in tighter labor markets, leaving a surplus of job openings compared to available workers. While historically lower labor costs have granted SEA-5 countries a competitive advantage over China, the current tight labor market could curtail this edge while also contributing to inflation and acting as a capacity constraint within the SEA-5 region.

Bolstering labor productivity as a strategy to raise the ceiling on the labor capacity constraint

As population growth and urbanization will likely continue to support increased labor capacity, SEA-5 governments are seeking to further support growth in capacity by enhancing labor productivity. Efforts include upskilling the labor pool, primarily centering on initiatives like fostering the advancement of technical and vocational education and training (TVET), alongside implementing extensive upskilling programs. While Indonesia, Malaysia, the Philippines, and Thailand retain potential to expand their manufacturing worker pool from other portions of the economy, Vietnam’s manufacturing sector has already achieved a substantial 33% share of the workforce. This figure suggests limited flexibility for Vietnam to reallocate its labor force and a limit to the ability of the government to influence labor capacity in manufacturing.

Looking ahead: Industry specialization

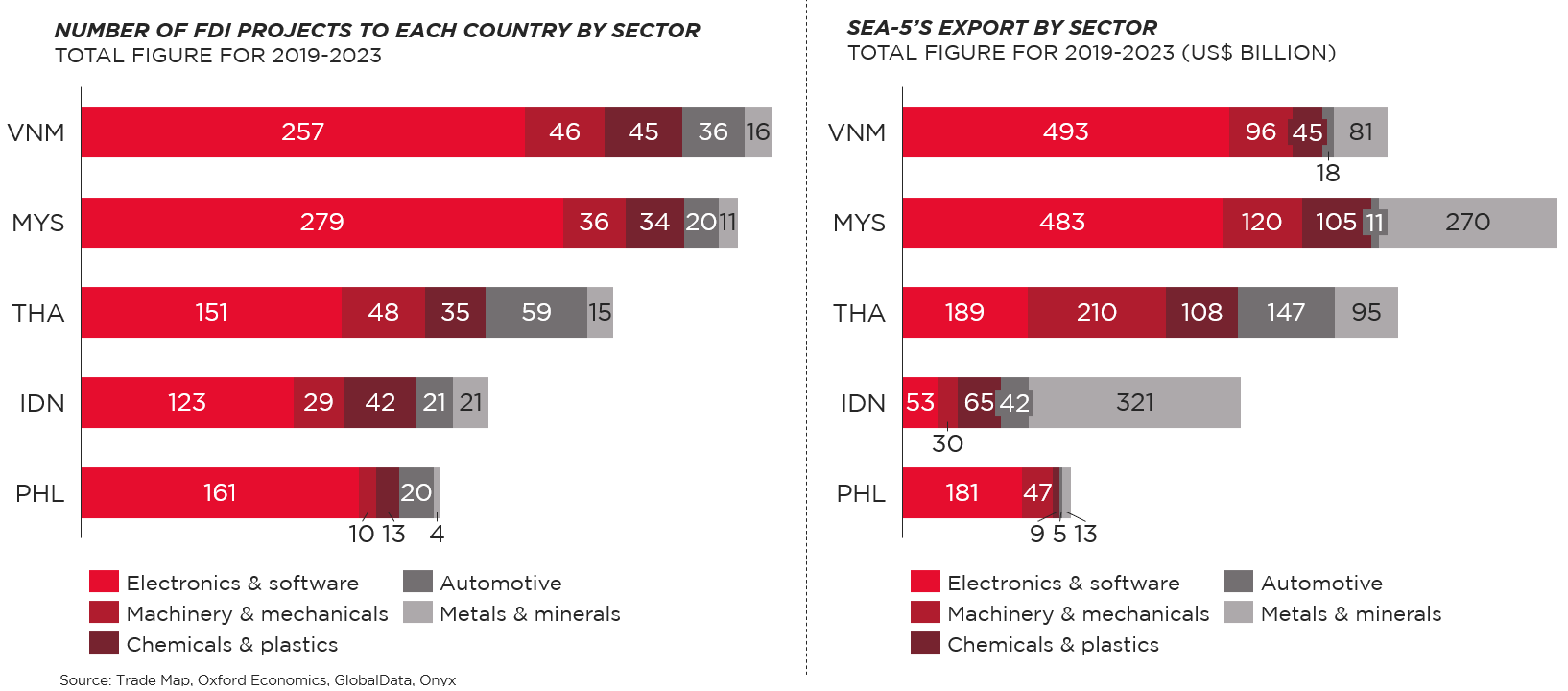

As the SEA-5 grapples with challenges in augmenting labor productivity, policymakers are supplementing labor productivity pushes with industry specialization. This strategic adjustment facilitates more efficient resource allocation by concentrating on the production of specific goods. Examination of inbound FDI projects and exports unveils three principal industrial clusters: electronics, machinery and automotive, and metals and minerals.

Electronics stands out as the flagship sector for Malaysia, the Philippines, and Vietnam. Malaysia and the Philippines specialize in integrated circuits, semiconductors, and industrial electronics, while Vietnam excels in manufacturing consumer electronics. Thailand has emerged as a pivotal player in the automotive and machinery industries, earning the moniker 'The Detroit of Asia.' Leveraging its abundant natural resources, Indonesia's industrial development strategy focuses on the mining sector, particularly nickel, stainless steel, aluminum, and copper.

Governments in the region recognize this phenomenon and are seeking to further specialization to achieve comparative advantages:

- Indonesia's strategic focus will center on downstream development within the mining industry, particularly targeting bauxite, copper, and tin.

- Malaysia's forthcoming initiatives, outlined in the New Industrial Masterplan, will prioritize the expansion and enhancement of the semiconductor supply chain.

- The Philippines, will spotlight the green industry as a central pillar of its Comprehensive National Industrial Strategy.

- Thailand is set to bolster industries such as electric vehicles, medical devices, smart farming, and precision agriculture, supplementing its traditional strengths in automotive and machinery sectors.

- Vietnam's trajectory will see an elevation of the electronics industry to a pivotal position, driven by the implementation of two key action plans: nurturing supporting industries and launching targeted training programs for the electronics workforce.

Topics: Southeast Asia, Labor, Nearshoring

Written by Onyx Strategic Insights