Search our articles

Southeast Asian Leaders Unveil Ambitious Policies at 2024 Nikkei Forum

Key Insights:

- What is happening: At the Nikkei Forum, Southeast Asian leaders shared insights on upcoming policy initiatives. Vietnam is prioritizing infrastructure and energy improvements. Malaysia aims to advance in the semiconductor value chain. Additionally, ASEAN countries are negotiating the ASEAN Digital Economy Framework Agreement (DEFA).

- Why it matters: Each of these policy initiatives seeks to address key concerns of businesses in Southeast Asia. Key impediments include infrastructure reliability, de-risked access to key inputs such as semiconductors, and concerns about regulations such as the uneven landscape of data privacy.

- What happens next: These policies will go some way in addressing Vietnam’s infrastructure reliability and in improving semiconductor availability in the region via Malaysia while stopping short of fully resolving these issues. Meanwhile, the DEFA agreement is unlikely to move forward in the proposed timeframe due to a persistent gap in desired outcomes.

ANALYSIS

At the 2024 Nikkei Forum in Tokyo, Southeast Asian leaders discussed upcoming policy. These policies have varying likelihoods of implementation and success in addressing these constraints on SE Asia’s attractiveness for companies seeking an alternative to China.

Vietnam plans to improve transport infrastructure, address frequent power outages, and mitigate drought-related water shortages. Over the last decade, Vietnam has invested 6% of its GDP in infrastructure; however, the country’s focus on large-scale railway, seaport, and airport projects often take precedence over the need for reliable utilities in fast-growing industrial clusters.

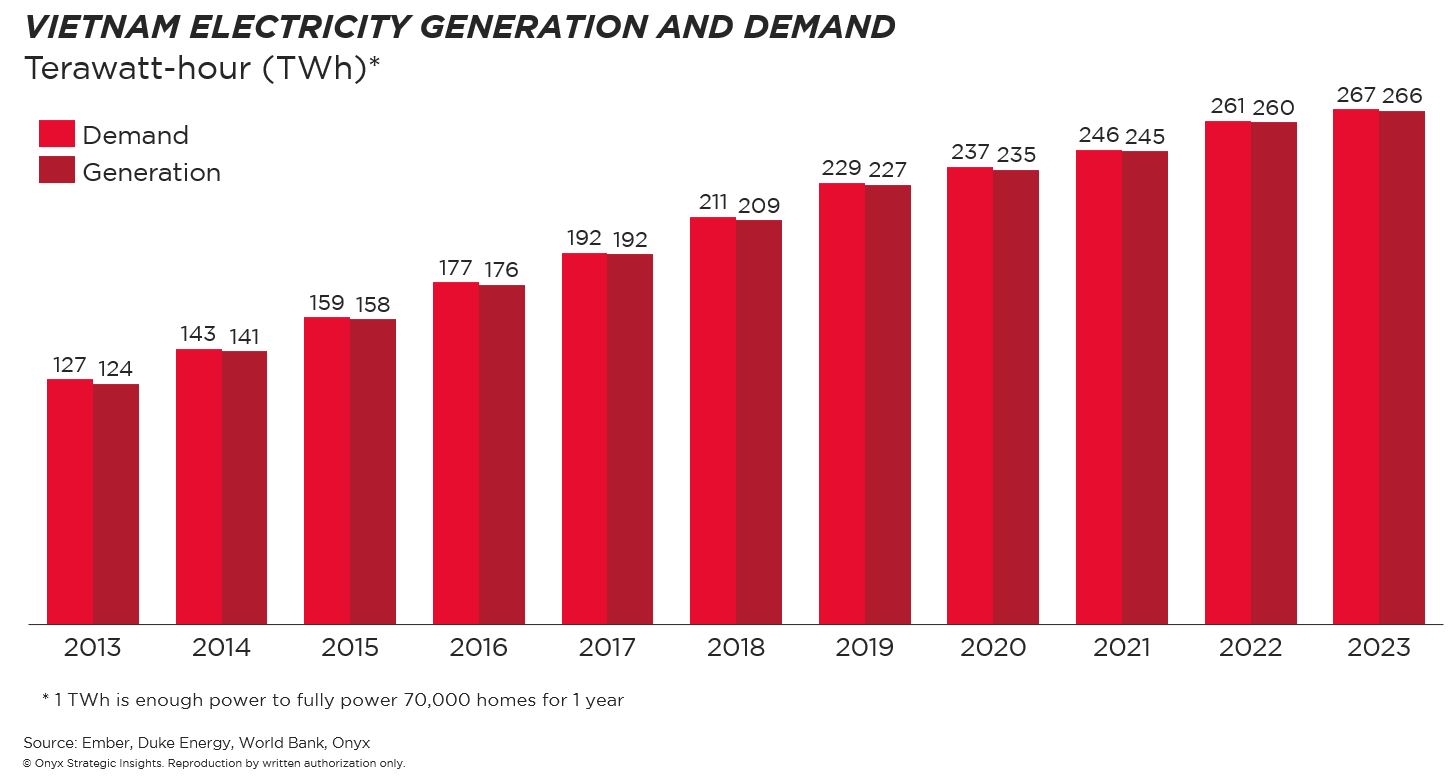

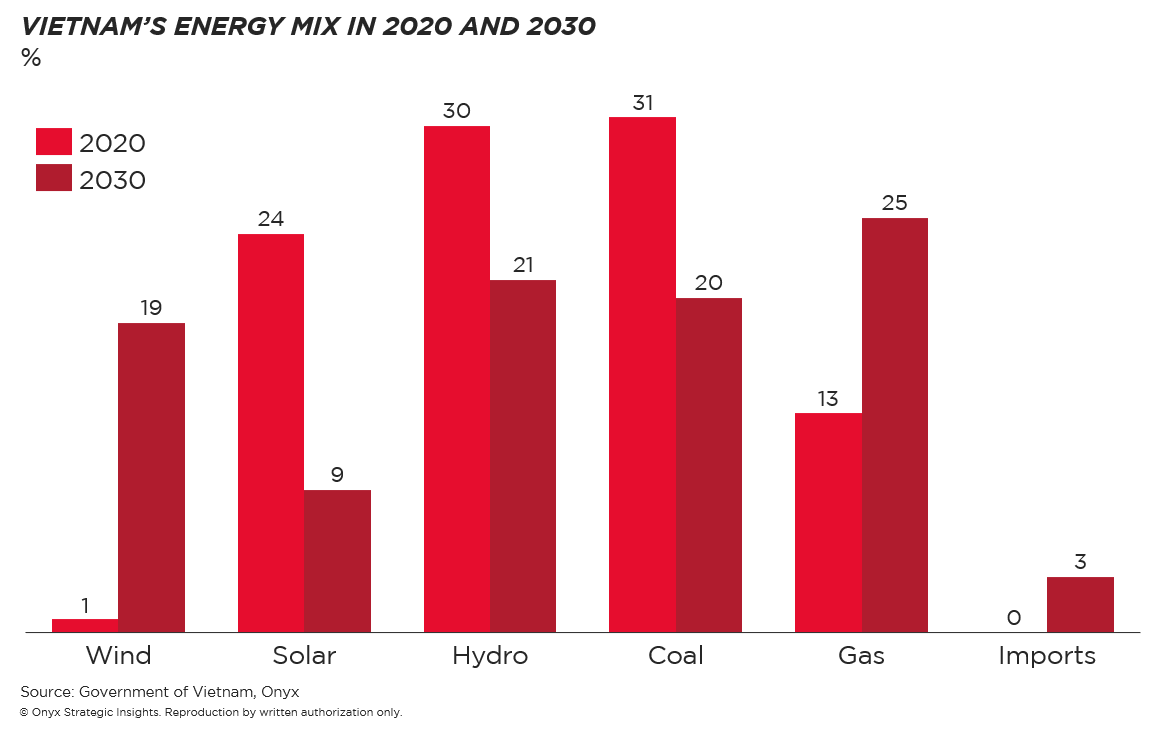

In the case of electricity generation, seasonal variations from a high reliance on hydroelectric power means that Vietnam’s capacity frequently falls short. Vietnam is seeking to expand wind and natural gas generation as well as electricity imports from Lao PDR, with implications for grid reliability and emissions. While incremental improvements should be expected as new generation comes online, Vietnam may continue to struggle to keep pace with demand.

Malaysia aims to advance its semiconductor industry up the value-chain as companies seek to diversify and localize supply in the face of geopolitical competition. At the moment, Malaysia’s key difficulty is a shortage of highly qualified workers. Malaysia plans to invest more in STEM education and vocational training to bolster its talent pipeline. It aims to double the manufacturing median wage by 2030, however, this remains far below Singapore's engineer salary, posing challenges in talent retention. Betting on this particular industry comes with serious risks of supply gluts as many countries turn to industrial policy to grow their manufacturing base, but may come with significant advantages to countries that manage to develop the key input.

Lastly, the ASEAN DEFA seeks to establish the first comprehensive region-wide digital economy agreement. Should an agreement come to fruition, companies will face challenges in choosing where to locate datacenters in the newly liberalized landscape. For instance, a country like Lao PDR offers a considerable advantage in terms of electricity and water cost and availability. On the other hand, companies will need to consider the risk of hosting data in a country with deep ties to China in the midst of concerns about China’s data collection policies. Many companies may opt to locate datacenters in countries that are well positioned for electricity imports from Lao PDR, such as Malaysia, to reduce such risks while lowering costs.

Nonetheless, concluding the ASEAN DEFA by 2025 faces challenges due to divergent data localization policies among member states, a desire to collect tax revenue on data centers, and general concerns about trusting privacy to another country. Due to these concerns, this policy is likely to stagnate.

Topics: Southeast Asia, Infrastructure

Written by Onyx Strategic Insights