Search our articles

Trajectory of the Red Sea Crisis and its Impact on Global Commerce

Key Insights:

- What happened: In reaction to Israel’s military activity in Gaza, Yemen’s Houthis initiated a series of attacks in the Red Sea, causing disruptions to the shipping route connecting Asia to Europe through the Suez Canal.

- Why it matters: The disruption has resulted in a significant surge of 226% and 69% in shipping costs from Asia to Europe and the US, respectively, as a growing number of shipments are being rerouted via the Cape of Good Hope. Businesses should expect a continued rise in shipping rates as the crisis prolongs.

- Moving forward: The crisis is likely to persist in the short to medium term, contingent upon the resolution of the Israel-Hamas conflict. A positive outcome from the peace negotiations between the Houthi and Saudi Arabia could potentially alleviate this crisis and normalize shipping via the Suez Canal.

ANALYSIS

What is unfolding in the Red Sea?

The Red Sea holds strategic importance as the sole gateway to the Suez Canal from Asia, a vital waterway responsible for facilitating approximately 14% of global maritime trade. Vessels traveling from Asia traverse the 30-kilometer-wide Bab-el-Mandeb strait to access the Suez Canal, with nearly half of their freight consisting of containerized goods. This route is particularly crucial for transporting oil from the Persian Gulf to Europe and North America.

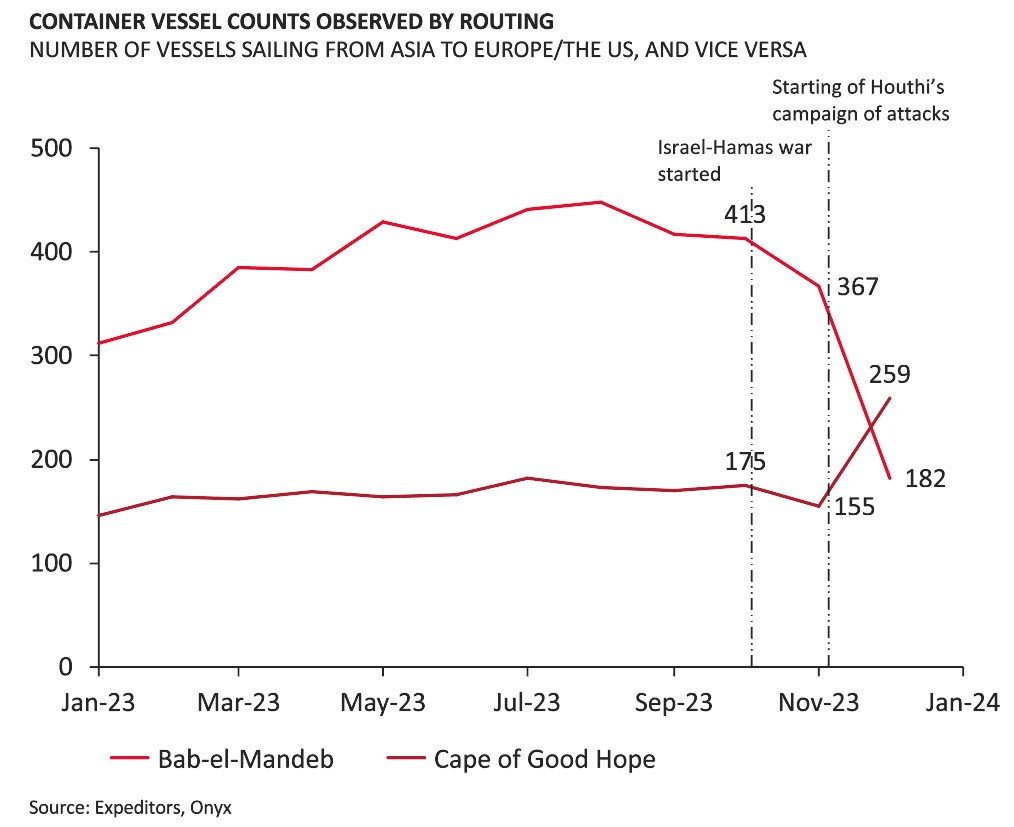

Following the Israel-Hamas war, the Iran-backed Houthi rebel group has intensified its attacks on commercial vessels navigating the Bab-el-Mandeb strait, recording at least 26 incidents since late November 2023. These attacks have prompted major shipping companies to suspend their Red Sea routes. Data show that companies are shifting volumes to the Cape of Good Hope. This alternative route adds approximately 6,000 kilometers to shipment journeys connecting Europe and Asia, extending the trip duration by around 10 days.

Impact on global trade

Shifting shipping routes from the Suez Canal to the Cape of Good Hope is estimated to raise fuel costs by up to $1 million per round trip between Asia and Europe. Short-term rates for container shipping between Asia, Europe, and the US are rising due to reduced capacity stemming from threats in the Red Sea.

The cost of shipping a 40-foot container from Asia to Northern Europe has surged to over $4,700, indicating a 226% increase since mid-December. Likewise, rates from Asia to North America's East Coast have climbed by 69% to $4,234. A further surge in shipping rates is expected as the crisis persists. Additionally, there is a 15-30% uptick in rail freight rates between China and Europe due to heightened demand for rail services arising from the Red Sea crisis.

The inflationary impact of escalating shipping costs depends on the duration of this crisis. If the crisis persists, it is likely to have a significant adverse effect on the global economy. According to an IMF study, shipping costs play a pivotal role in driving global inflation. A doubling of the Baltic Dry Index (BDI) results in an average increase of 0.7 percentage points in inflation. Importantly, these effects are enduring, reaching a peak after a year and lasting up to 18 months.

What is the trajectory of the crisis?

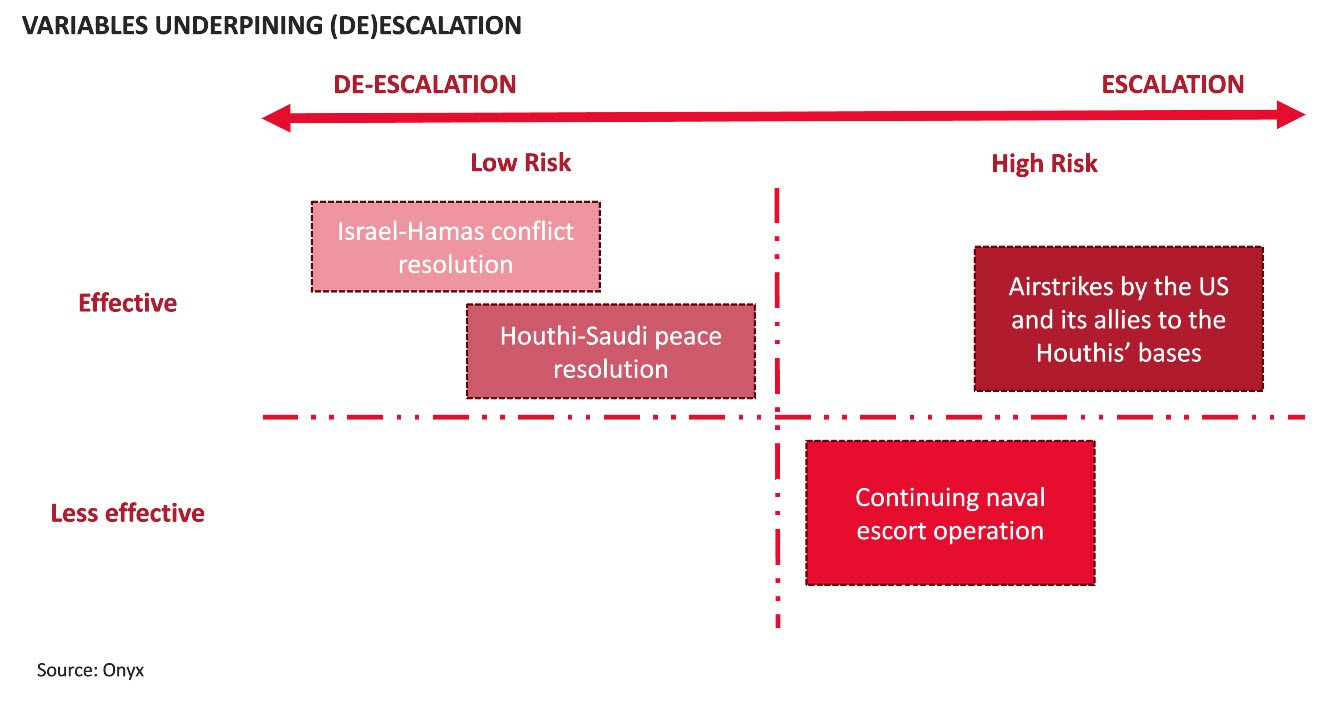

The Red Sea crisis is expected to persist in the short to medium term. Despite the exchange of fire with US military vessels, the Houthis remain focused on attacking merchant ships in the Red Sea, indicating that the US-formed escort alliance will not effectively deter them.

Publicly, the Houthis’ decision to attack commercial vessels in the Red Sea has been justified as a response to Israeli military activity in Gaza, and any steps towards de-escalation between Israel and Hamas could potentially alleviate tensions in the Red Sea.

Behind the scenes, however, the Houthis might also leverage the attacks to enhance their position in peace talks with Saudi Arabia, and to achieve recognition as Yemen’s legitimate government. The peace effort, mediated by Oman, resumed in April 2023 but is yet to bear fruit. Equally important are the China-led efforts towards a rapprochement between Saudi Arabia and Iran. Any positive movement in either could support a defusal of the Red Sea crisis.

The current naval escort operation led by the US and its allies is yet to show effectiveness in addressing the long-term strategic goal of halting Houthi attacks permanently. While airstrikes on Houthi positions are an option, they would likely require significant resources and come with a high risk of triggering a broader regional conflict. Other options such as airstrikes in Iranian territory exist but would also represent a significant and risky escalation. The US appears to be working behind the scenes to reach a negotiated settlement rather than risk such an escalation.

Topics: Middle East

Written by Onyx Strategic Insights