Search our articles

Vietnam’s energy conundrum: balancing decarbonization and industrial growth

Key Insights:

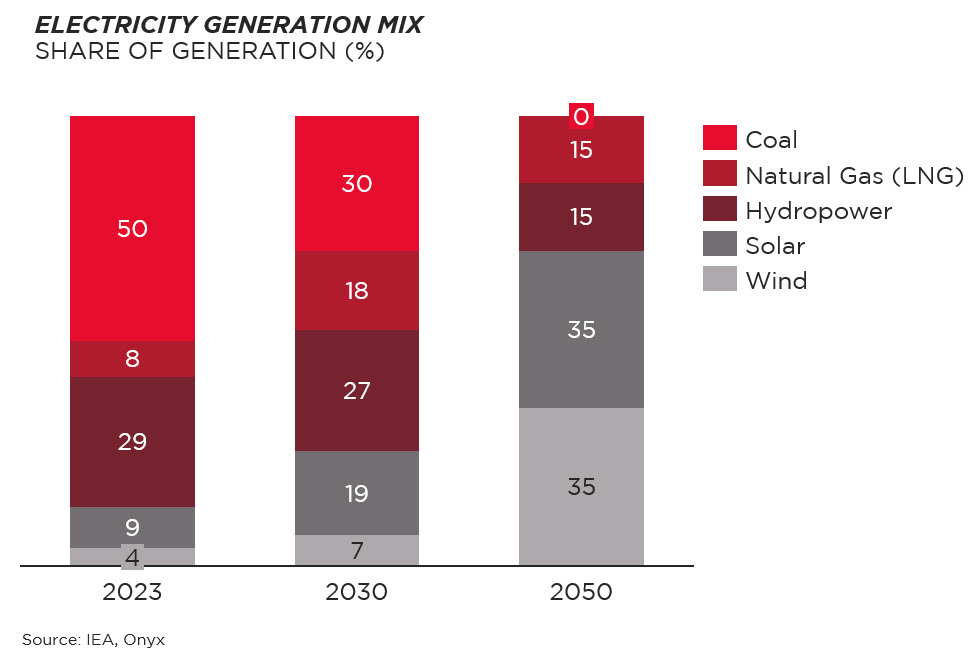

- What is happening: In 2023, the Vietnamese government approved the National Energy Master Plan for 2021–2030, aiming to ensure a sufficient energy supply to support 7% economic growth, with renewables contributing up to 53% of total energy sources by 2030 and up to 85% by 2050.

- Why it matters: Balancing the growing use of renewable energy with the need for a stable energy supply to support Vietnam's rapidly expanding industry poses significant challenges, primarily due to the intermittent nature of renewables. Power outages remain a key risk for businesses considering supply chain diversification to Vietnam, making energy reliability a critical concern.

- What happens next: Vietnam is diversifying its energy strategy by investing in LNG power plants development for stabilizing energy supply and reconsidering nuclear power for long-term energy security and emissions reduction, despite challenges such as price volatility, political resistance, and infrastructure constraints.

ANALYSIS

Vietnam’s ambitious energy goals

The National Energy Master Plan reflects Vietnam’s commitment to sustainable development. Presently, the country relies heavily on coal and hydropower for its electricity needs. The transition to a future energy mix dominated by renewables signals a decisive shift in priorities, addressing global climate concerns while securing energy for economic growth. Key features of the plan include reducing dependence on coal-fired power plants and scaling up investments in solar and wind energy projects.

Balancing decarbonization efforts with a stable energy supply will be a challenge

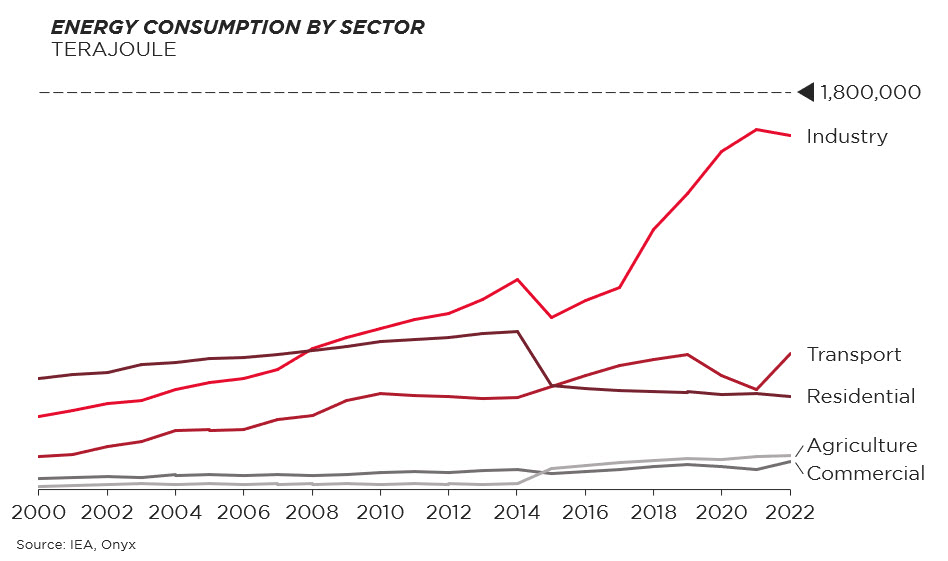

Managing an increasing share of renewable energy presents a technical and logistical conundrum. Industrial growth has fueled Vietnam’s energy demand, making reliability a critical concern. Frequent power outages have already raised alarms among international businesses considering Vietnam as a key player in diversified supply chains. Such disruptions could undermine Vietnam’s attractiveness as a manufacturing hub, particularly for energy-intensive industries like electronics and textiles.

Addressing this challenge requires significant investment in energy storage solutions and grid modernization. Battery technologies, smart grid systems, and demand-side management will play pivotal roles in mitigating the impact of renewable energy’s intermittency. However, the costs associated with these upgrades are substantial and require public and private sector collaboration.

LNG and nuclear are being considered to balance energy reliability and decarbonization

Vietnam is expanding its energy strategy to balance reliability and decarbonization by investing in liquefied natural gas (LNG) and reconsidering nuclear power. LNG power plants offer stability to complement renewables but expose Vietnam to risks such as price volatility and geopolitical supply disruptions.

Nuclear energy presents a long-term solution for energy security and emissions reduction. As a zero-emissions source, it could help stabilize Vietnam’s grid while supporting climate commitments. However, political resistance, public skepticism, high costs, and a lack of infrastructure and expertise pose significant barriers.

Despite these challenges, Vietnam plans to build 15 LNG power plants by 2035 with a combined capacity of over 22 GW. Additionally, the Vietnamese government has approved restarting the Ninh Thuan nuclear project and signed an agreement with Russia to expand nuclear cooperation. These steps underscore Vietnam’s focus on balancing energy reliability and decarbonization rather than relying solely on renewables

Topics: Southeast Asia, Infrastructure, Energy

Written by Onyx Strategic Insights