Search our articles

EU-Vietnam Free Trade Agreement: business impacts and outlook under CBAM

Key Insights:

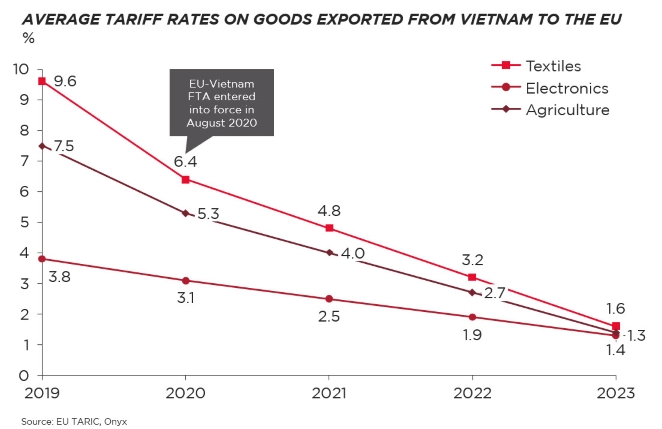

- What is happening: The EU-Vietnam Free Trade Agreement (EVFTA), effective from August 1, 2020, aims to eliminate 99% of tariffs by 2030, offering Vietnam significant opportunities in sectors like textiles, electronics, and agriculture, while providing the EU greater access to Vietnam’s growing economy and consumer market.

- Why it matters: The EVFTA enhances the movement of goods between Vietnam and the EU by lowering tariff rates on Vietnamese exports and implementing supportive trade facilitation measures. These measures, such as self-certification of product origin, post-clearance audits, and risk-based customs inspections, benefit businesses by making trade more efficient and cost-effective.

- What happens next: The EU's Carbon Border Adjustment Mechanism (CBAM) may challenge the EVFTA's effectiveness for Vietnam’s carbon-intensive industries like steel, cement, and aluminum by increasing export costs and reducing competitiveness. These sectors will need to adopt cleaner technologies to stay competitive. Meanwhile, agro-products and electronics, with lower carbon footprints, may face less immediate impact but will still need to align with EU climate policies in the future to ensure continued market access.

The importance of the EVFTA

The EU-Vietnam Free Trade Agreement (EVFTA), which came into effect on August 1, 2020, represents a significant milestone in economic relations between the European Union and Vietnam. This agreement is designed to eliminate 99% of tariffs between the two parties by 2030.

For Vietnam, the EVFTA offers significant opportunities, especially for sectors like textiles, electronics, and agriculture. The EU is one of Vietnam’s largest export markets, and the tariff reductions under the EVFTA provide businesses operating in Vietnam with a competitive edge. On the other hand, the EU stands to benefit from greater access to Vietnam’s fast-growing economy and expanding consumer market.

The EVFTA enhances the movement of goods between Vietnam and the EU

This agreement facilitates the reduction of import duties, significantly reducing costs for businesses, and encouraging the smoother movement of goods. Additionally, the EVFTA has also introduced several key trade facilitation measures that make trade more efficient for businesses. These include:

- Self-certification: under the EVFTA, exporters can self-certify the origin of their products rather than relying on certificates of origin from government authorities.

- Post-clearance audits: the EVFTA supports the use of post-clearance audits, meaning customs authorities can conduct audits after goods have been released, rather than holding goods for extended periods at borders.

- Risk-based customs inspection systems: the agreement promotes the use of a risk-based inspection systems, where goods deemed to be low risk are subject to fewer physical inspections to expedite the clearance process.

Future outlook: impact of CBAM on the EVFTA

The implementation of the EU’s Carbon Border Adjustment Mechanism (CBAM) definitive regime in January 2026 could impact the effectiveness of the EVFTA, particularly for Vietnam’s carbon-intensive industries, such as steel, cement, and aluminum, which are key export sectors under the EVFTA. These industries may face higher export costs due to CBAM’s carbon tariffs. The additional costs associated with CBAM could reduce their competitiveness in the EU market.

Moreover, Vietnam’s environmental regulations for heavy industries are less developed compared to the EU's stringent carbon measures. Although the government has committed to net-zero emissions by 2050, implementation in heavy industries remains slow. Therefore, significant investment in renewable energy sources and improving energy efficiency in production is still needed to decarbonize the sector sufficiently to meet the standards expected under CBAM.

Topics: Europe, Southeast Asia, Trade, ESG, Trade Agreement

Written by Onyx Strategic Insights