Search our articles

European Elections 2024: Results and Aftermath

Key Insights:

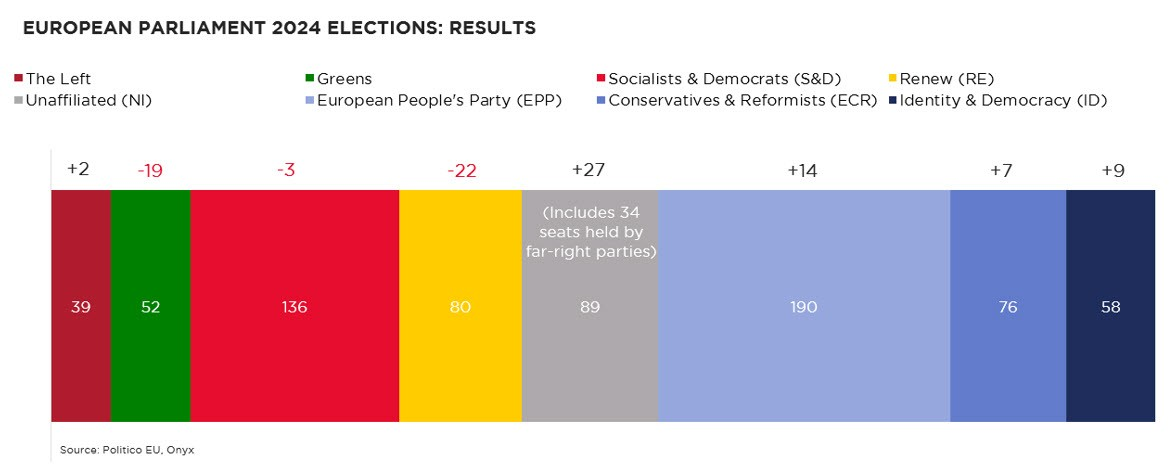

- What is happening: The June 6-9 European elections have resulted in a higher vote share for far-right parties, which will now hold a quarter of seats in the European Parliament. The center-right European People’s Party (EPP) remains the largest and most influential party.

- Why it matters: A more right-wing European Parliament will reduce the introduction of new sustainability initiatives, but won’t drive massive changes in EU policymaking. Bigger changes are playing out at the national level in France, where a larger-than-expected vote share for far-right parties prompted President Emmanuel Macron to call snap elections.

- What happens next: Selections for Commission posts will play out in the coming weeks, culminating in the likely re-election of Ursula Von der Leyen as Commission President. In France, legislative elections will occur in two rounds on June 30 and July 7. The outcome is highly uncertain, but most scenarios point to reduced power for Macron and his reform agenda.

ANALYSIS

EU election results

The EU Parliament election results align with pre-election polling and Onyx’s forecasts. Far-right parties – which mostly fall under the Conservatives & Reformists (ECR) and Identity & Democracy (ID) groupings – picked up substantial vote share, and exceeded expectations in France and Germany. Their success came at the expense of the Greens and liberal centrist Renew grouping. The traditional center-right European People’s Party (EPP) also picked up seats.

Overall, the results signify a swing to the right in European politics, with voters increasingly turning against immigration and climate mitigation policies.

EU policy implications

Consistent with Onyx’s expectations, the biggest impact of the European elections will be a slowdown in the introduction of “green” legislation and policy initiatives. The Green Deal agenda has largely run its course, and focus will now shift toward implementation of already-approved legislation. Other policy areas are unlikely to see substantial change in direction. Ursula von der Leyen is likely to remain Commission President, and power within the Parliament will generally remain with the center-right EPP.

Global companies and supply chain executives should expect continued implementation of policies like the EU’s Carbon Border Adjustment Mechanism (CBAM), forced labour and deforestation regulations. Traditional FTAs, including the EU-Mercosur agreement, aren’t likely to see much progress. On Russia sanctions, expect maintenance of the existing sanctions regime, extension to new products and increased crackdowns on diversion through third countries.

France’s snap elections

The bigger surprise of the European elections is the national fallout in France. At 31%, Marine Le Pen’s far-right National Rally exceeded expectations with double the votes of President Emmanuel Macron’s coalition (16%).

An apparent backlash against his policies prompted Macron to make the gutsy and unusual move to call snap legislative elections for June 30 and July 7. Macron hopes far-right and far-left parties will either fall short of expectations – allowing him to regain control – or that their success will force them into government, exposing their policies to greater scrutiny ahead of France’s national elections in 2027.

So far, opinion polls for the first round put the National Rally in first place (33%), followed by a consolidated left-wing coalition (28%) and Macron’s Ensemble in third place (18%). The campaign so far has been marked by dramatic and chaotic shifts in alliances between parties, and much could change ahead of the first vote and between the first and second rounds.

Most scenarios point to increased confusion and fragmentation in French politics, reduced power for Macron’s coalition and an end to his liberal reform agenda. Companies that trade or operate in France can expect fewer business-friendly policies and regulatory reforms going forward. A downside scenario would entail big gains for extremist parties, prompting an immediate bond market reaction and economic downturn.

Written by Onyx Strategic Insights