Search our articles

Indonesia 2024 Elections: Impact on Industrial and Climate Policies

Key Insights:

- What happened: The upcoming presidential election in Indonesia, scheduled for February 14, 2024, features three prominent candidates with similar policy platforms. All three candidates are advocating for the growth of Indonesia's manufacturing sector through an industrial downstreaming strategy to increase the production of higher value-added goods and the development of a green energy sector.

- Why it matters: The goal to elevate the production of higher value-added goods within Indonesia, while curbing the export of raw materials, will intricately influence company sourcing and production strategies, with effects differing across industries. Furthermore, with Environmental, Social, and Governance (ESG) factors gaining importance for companies, transitioning to cleaner energy sources could enhance Indonesia's appeal for attracting private investment.

- What happens next: The incoming Indonesian president is poised to prioritize downstreaming in the mining sector and extend this approach to agriculture, fishery, and forestry. In contrast, the trajectory of Indonesia's climate policy remains uncertain, given the potential reliance on coal power plants to drive industrialization.

ANALYSIS

Three different candidates, similar policy platforms

The upcoming presidential election in the world's fourth-most-populous nation involves a staggering 204.8 million eligible voters. Competing for the position are Defense Minister Prabowo Subianto, former Central Java Governor Ganjar Pranowo, and former Jakarta Governor Anies Baswedan. The defense minister, whose running mate is the son of the incumbent president, Joko Widodo, has emerged as the frontrunner among the three candidates.

The candidates appear to have distinct approaches to their campaigns. Anies emphasizes the need for change, while Prabowo and Ganjar pledge to uphold and advance the progress initiated by President Joko Widodo. However, upon closer examination of their proposed programs, all three candidates present relatively similar policy platforms. Notably, two key policy areas emerge as crucial to each candidate: the promotion of industrialization through a downstreaming strategy and the commitment to an energy transition facilitated by an initiative known as the Just Energy Transition Partnership (JETP).

A divergence between industrial and climate policies

The downstreaming strategy in the nickel industry plays a crucial role in the current administration's industrial policy. This approach is primarily aimed at enhancing the value of nickel products, with a strategic goal of establishing a robust EV battery supply chain. All three candidates endorse the continuation of this policy in their respective proposals.

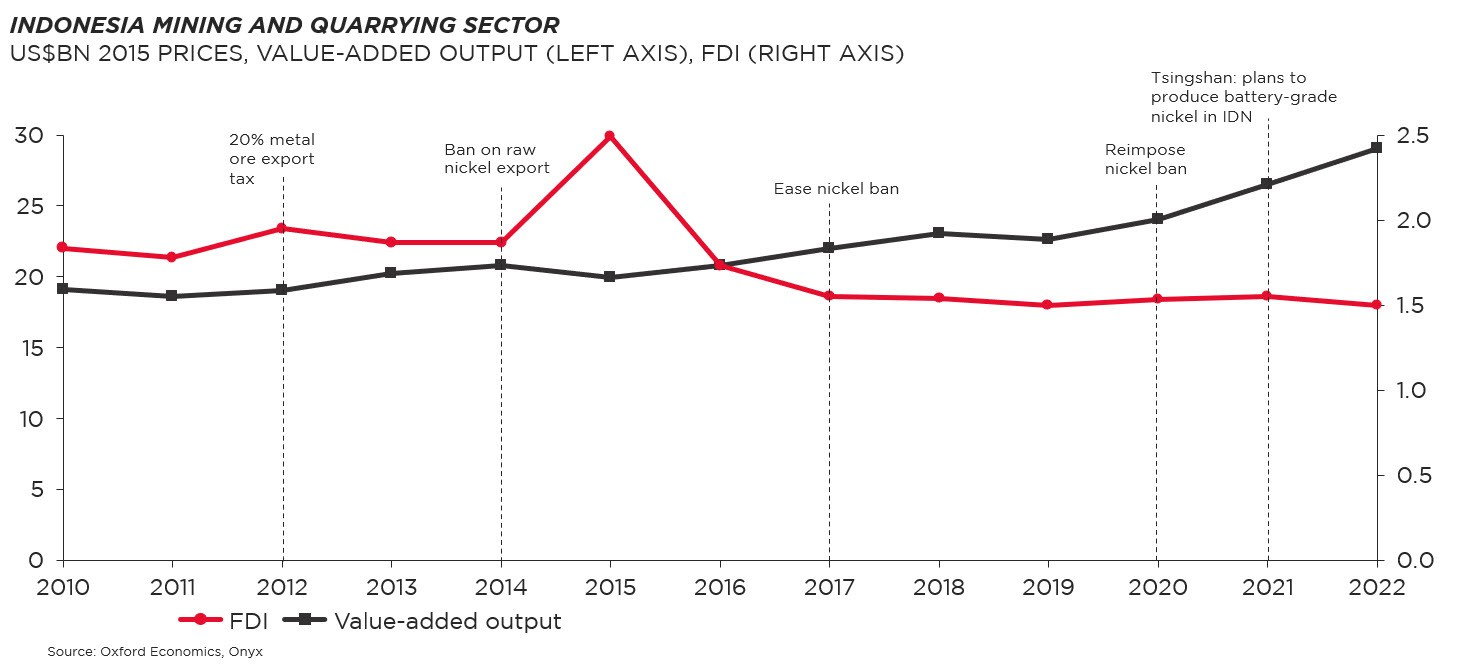

In terms of attracting investments and producing value-added output, Indonesia's nickel downstreaming policies have yielded positive outcomes. In 2020, the nation implemented a ban on the export of raw nickel ore to encourage investments, particularly in nickel smelters dedicated to producing stainless steel and ferronickel. As of July 2023, there were 43 operational nickel smelters, with 28 under construction and 24 in the planning phase.

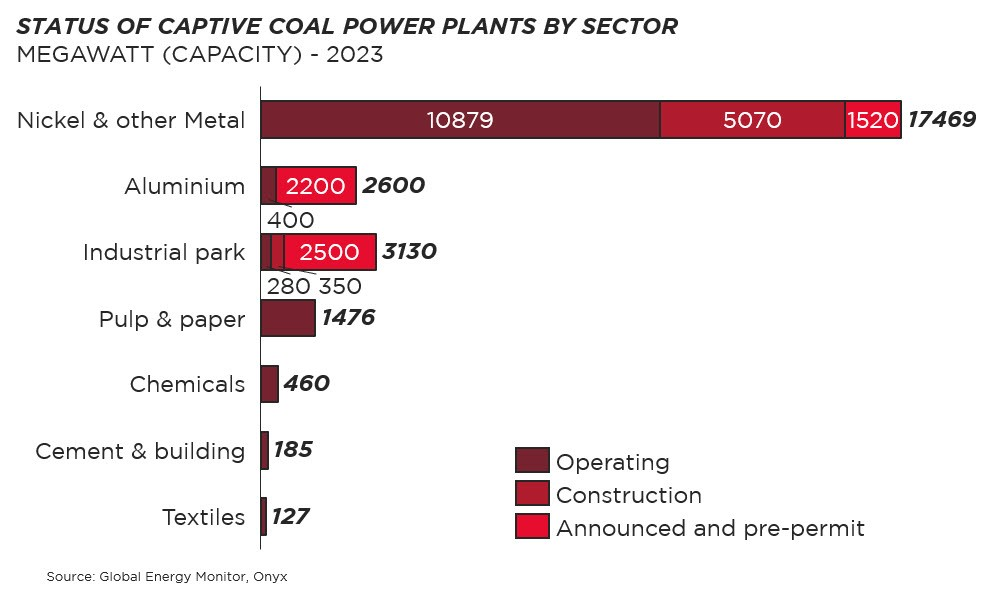

However, a noteworthy concern arises from the substantial carbon footprint associated with these smelters, attributed to the use of captive coal power plants (off-grid) for the smelting process. Currently, captive coal power stations with a total capacity of 13.74 gigawatts (GW) are operational in the Southeast Asian archipelago, and an additional 20.48 GW are in the planning stages. Despite Indonesia's commitment to refrain from commissioning new coal power plants under the Just Energy Transition Partnership (JETP) initiative, exceptions persist for new plants dedicated to smelting operations. This discrepancy raises questions about the alignment of these conditions with Indonesia's ambitious climate policy and its net-zero target.

A balancing act is needed, what’s next?

Downstreaming stands as a crucial milestone to elevate Indonesia's position in the global value chain and to enhance the competitiveness of its manufacturing sector vis-à-vis other emerging markets. The success of nickel downstreaming to increase Indonesia’s value-added output has made it a cornerstone policy, prompting all three candidates to propose its extension beyond mining into the broader sectors of agriculture, fishery, and forestry.

To facilitate this expansion, the government is likely to employ export bans as a key instrument. Consequently, companies should anticipate potential restrictions on raw material exports, such as copper, tin, and palm oil, in the future. However, there is a possibility that the government may shift from a straightforward export ban to a more adaptable Domestic Market Obligation (DMO) scheme, akin to those applied to coal and palm oil. Familiarity with this scheme within government and industry circles could facilitate its implementation.

Recognizing the growing significance of environmental concerns for companies investing in emerging markets, the incoming president is expected to prioritize these issues. Indonesia is likely to persist with its $22 billion Just Energy Transition Plan to foster sustainability in its power sector. Nevertheless, captive coal power plants will continue to play a substantial role in strategic projects aimed at enhancing value addition for natural resources, such as smelters.

Topics: Southeast Asia, Industrial, ESG

Written by Onyx Strategic Insights