Search our articles

Mexico’s Elections and the Future of Nearshoring

Key Insights:

- What is happening: Mexico goes to the polls on June 2 to elect a new president and legislature. Claudia Sheinbaum is favored to win the presidency. As the hand-picked successor to current president Andrés Manuel López Obrador (AMLO), Sheinbaum will continue many of his policies.

- Why it matters: Mexico is experiencing an investment surge despite minimal federal government support and as businesses in Mexico face deteriorating infrastructure and security.

- What happens next: Sheinbaum has promised to facilitate investment and prioritize the US-Mexico relationship. However, it is uncertain whether she will be able to pursue business-friendly plans – or if AMLO will govern behind the scenes. Overall, businesses in Mexico will likely see increased costs and lead times, stemming from rapid wage growth and a lack of meaningful infrastructure investment. Tensions with the US could also pose critical challenges to Mexico’s nearshoring moment.

ANALYSIS

Mexico’s elections

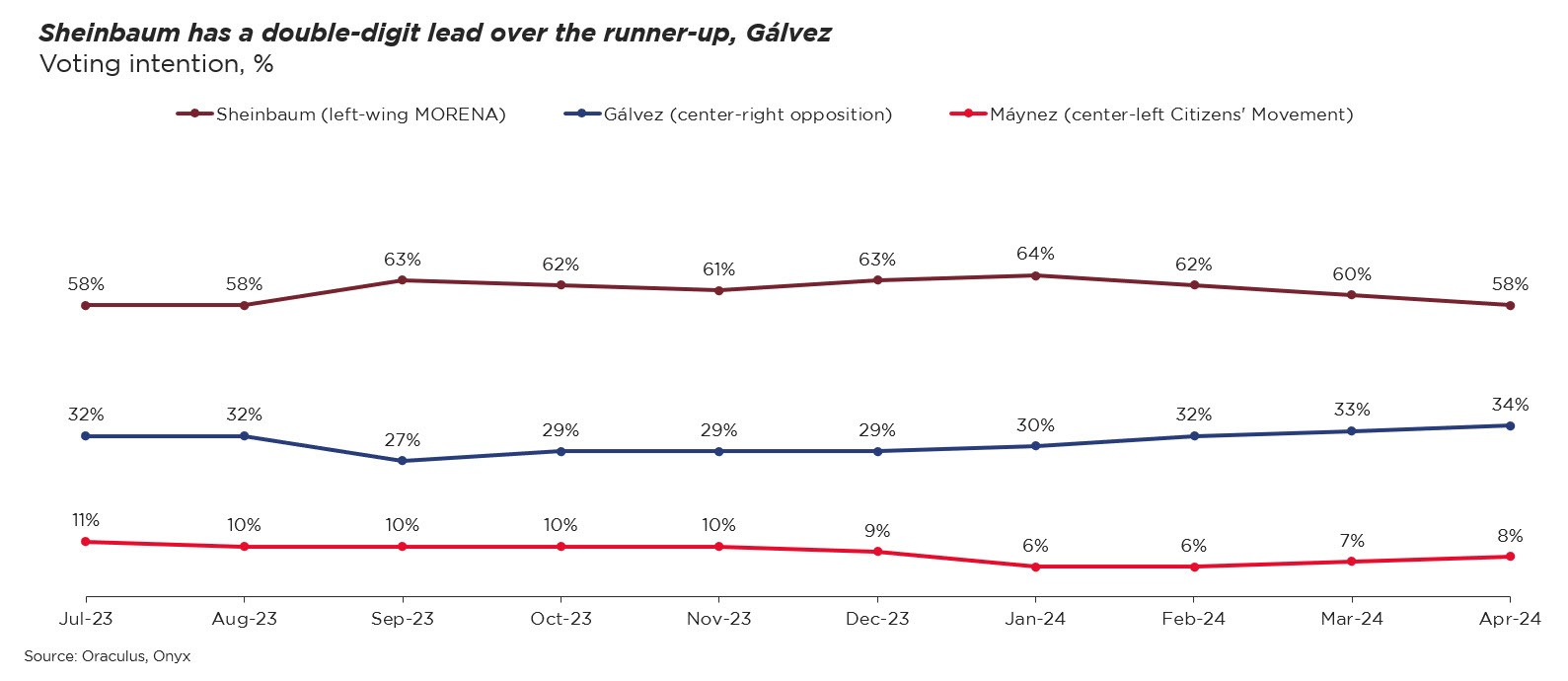

Main candidates and polling: Claudia Sheinbaum has a commanding lead in the presidential race over Xóchitl Gálvez and Jorge Álvarez Máynez and will likely win barring major events. Sheinbaum is likely to continue many of AMLO’s policies, including stronger workers’ rights, minimum wage increases, costly infrastructure projects, and big military spending increases – the latter, opponents say, are wasteful. Sheinbaum’s ability to break with AMLO will be limited by his popularity (69% approval) and influence.

Mexico’s operating environment

Nearshoring moment: Mexico’s election takes place amid rising foreign investment, largely from companies locating production close to US consumers. Investment is concentrated primarily in northern and central Mexico – particularly in Monterrey, Nuevo León.

Sectors hit by the Section 301 US tariffs on China – like furniture and consumer electronics – are among the greatest beneficiaries, as are clean energy tech targeted by the United States’ Inflation Reduction Act. The US remains the largest source of foreign investment, but Chinese investment is growing rapidly.

Looking ahead

Persistent challenges for business: More likely than not, existing issues will persist and deteriorate due to low state capacity and years of underinvestment in necessary infrastructure. While firms have stomached these challenges, worsening conditions will continue to push the cost of business higher and reduce Mexico’s relative attractiveness through several avenues:

- Labor costs: Strong demand and strengthening workers’ rights are driving labor cost increases. Manufacturing wage growth averaged more than 8% annually since 2018 and is running ahead of productivity gains, eroding competitiveness. Sheinbaum is likely to continue hiking the minimum wage.

- Electricity and water infrastructure: In recent surveys, more than 90% of firms in Mexico’s industrial parks report issues with unreliable electricity and nearly two-thirds face water scarcity. Rising FDI inflows will further strain the system.

- Transport: Sheinbaum will likely continue a mandate to develop the south, which may raise its long-term prospects but does not address foreign businesses’ immediate transport needs in the north.

- Security: Cartel violence and cargo theft have been increasing. Whereas cargo theft historically concentrated at the northern border, incidents now extend throughout central Mexico. Sheinbaum’s proposed policies do not mark a major break with AMLO or reveal plans to move forcefully against the cartels.

US-Mexico relations after 2024: The future of Mexico’s nearshoring boom will also depend on its relationship with the US, which holds elections in November. The critical supply chain issue will be the 2026 review of USCMA in the context of unprecedented immigration across the US-Mexico border and surging Chinese investment into Mexico. Either Biden or Trump is likely to take a hardline stance on Chinese investment, but a Trump re-election poses additional downside risks for Mexico as a nearshoring destination if he were to raise trade barriers, continue to threaten direct action against cartels in Mexico, or introduce frictions at the border.

Topics: North America, Politics

Written by Onyx Strategic Insights