Search our articles

Parsing Through Recent Key US Economic Data: Policy Uncertainty Clouds the Outlook

Key Insights:

- US growth is slowing, but at a manageable pace. January data had some one-off headwinds - February data will be a better indicator of fundamental growth.

- Inflation is trending in the right direction, but risks are skewed to the upside with a long menu of potential tariffs.

- The Federal Reserve's "wait-and-see" stance is the right one for the time being, but it will be key to respond quickly to new fiscal and trade policies.

Recent data suggests a potential US slowdown, sparking some concerns. The Atlanta Fed GDPNow model, for instance, projects a -1.5% q/q annualized GDP contraction in Q1 2025 (as of Feb 28). We also saw a -0.5% decline in real personal consumption expenditures from December to January. Are households pulling back?

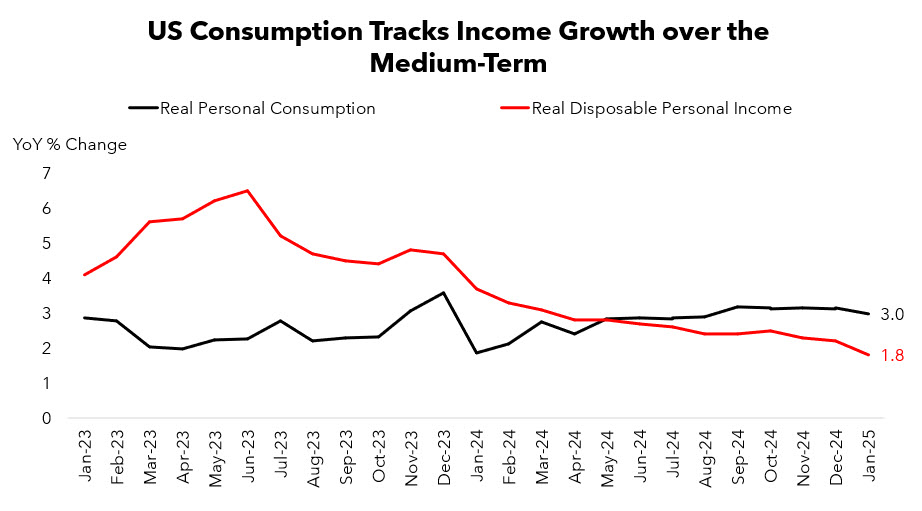

While concerning, we believe there were one-off factors at play in the January data. Severe weather likely suppressed spending and housing activity. Furthermore, Q4 2024 was exceptionally strong, suggesting some "pull-forward" of economic activity, making the month-to-month comparison appear worse. It's important to note that year-over-year spending is still growing at a healthy 3.0% (real rate).

Looking ahead, sustainable consumer spending tends to track real disposable income growth. This income growth has moderated from the 2023 and early 2024 highs to a more sustainable 1.8-2.0% range. This is likely where we'll see real consumer spending, and overall GDP growth, settle over the next 12-18 months.

Inflation also remains a significant concern. While Core PCE inflation showed improvement in January, policy uncertainty is a major wildcard. Adding downside pressure to inflation rates, fiscal austerity could dampen growth in Q1-Q2 (we'll be watching the evolution of DOGE closely), and tariff uncertainty may weigh on business investment.

However, new and proposed tariffs pose a substantial upside risk to inflation. The 10% (and, now, likely 20%) tariff on Chinese imports alone could add approximately 0.2 percentage points to inflation in the near-term. The broader suite of proposed trade policies – including tariffs on Canada, Mexico, the EU (autos), pharma, semiconductors, copper, a global reciprocal tariff, closing China's de minimis loophole, and the digital services tax – could significantly exacerbate inflationary pressures.

Topics: North America, Trade, Economy

Written by Onyx Strategic Insights