Search our articles

Scope of USG supply chain interests likely to be clarified by the end of 2024

Key Insights:

- What happened: The Biden Administration has vastly expanded the work of the Bureau of Industry and Security (BIS) within the Department of Commerce by directing the expansion of tariffs, export controls, and investment screening. Commerce is set to release a comprehensive list of strategic technologies that will form the basis of future export control and tariff regimes, including updated restrictions on EVs and their components.

- Why it matters: These restrictions will take place as part of broader efforts to counter China as a strategic rival to the United States throughout the US government. Increases in tariffs and investment screening on a wider swathe of technologies is likely to impact firms that previously benefited from relatively open trade regimes for their products.

- What comes next: The next US President and Congress will likely use this list as a tool for making decisions on trade-related policymaking as trade tensions with China continue to be a top bipartisan issue.

ANALYSIS

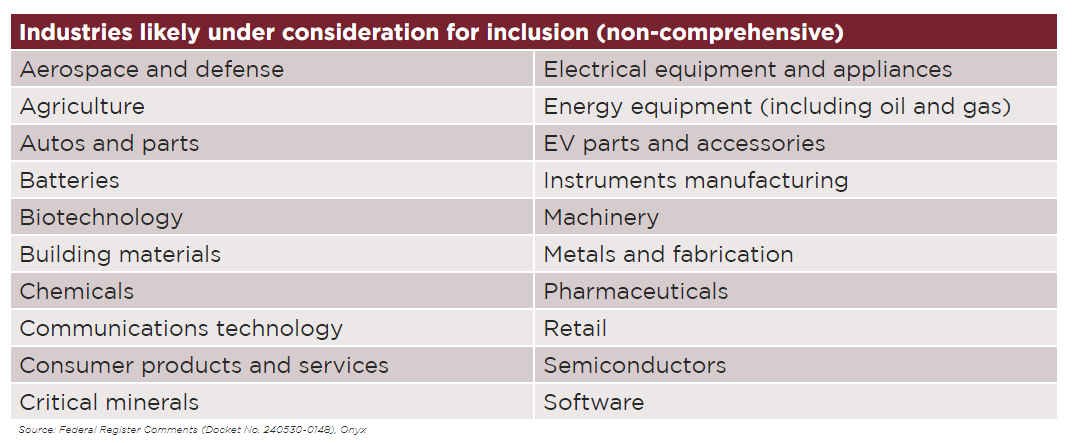

The US Department of Commerce is currently working on compiling a comprehensive list of critical sectors and key goods that they hope will encompass all trade they deem to be relevant to the geostrategic interests of the United States. At present, the US government has handled its policy actions aimed at certain industries on an ad-hoc basis in key areas of clear concern, such as semiconductors, steel and aluminum, and defense-related technologies. However, the establishment of this list means that industries and companies that have previous enjoyed a relatively open trade regime may be subject to heighted scrutiny, particularly if they do significant business with China or are reliant on Chinese firms for key inputs.

Regardless of the winner of the November 2024 presidential election, changes over the last several years that resulted in an expanded scope of work for the department in tackling national security issues through trade is likely to continue given broad consensus on the economic threat posed to US industries by China. In a second Biden term, we would likely see the administration building off this work to incrementally address industries of concern with policy changes, while a second Trump administration may be more prone to the use of blanket regulations and restrictions such as recent proposals by the candidate to implement blanket tariffs on China and the rest of the world.

It is important to note, however, that a broad expansion of either administration’s policy interventions will in some cases require Congressional support (or inaction in the case of delegated authorities in trade.) Triaging the resulting list and identifying appropriate policy tools – including investment restrictions, tariffs, entity list additions, and even industrial policy actions – will be a political process that in some cases involves Congress and potential Supreme Court challenges and may not always be successful. The list gives highly significant and much-needed insight into future administration actions, but doesn’t provide a conclusive roadmap for companies looking to determine policy impacts on their products.

Commerce is likely to release the list before the end of 2024, a significant step in prioritizing and actioning national security in trade policy. The department is likely to take a risk-based approach that mirrors previous technology restrictions, a necessity given the limited resources of the Bureau of Industry and Security (BIS) in its ability to evaluate flagged transactions as part of its work to protect US national security interests in the trade arena.

Topics: North America, Trade

Written by Onyx Strategic Insights