Search our articles

United States: IRA Faces Headwinds on Energy Transition

Key Insights:

- What happened: Disbursement of funds from the Inflation Reduction Act (IRA) is well underway. EV sales are on track, investment in the battery industry is fostering a new “battery belt” across the Midwest and South, and clean energy investments are rising. Even so, the US is falling short of investment needed to meet emissions targets by 2030. Funding will peak in 2024 but construction and approvals will take time and last well beyond the 2024 election.

- Why it matters: IRA investments policy objectives are to significantly reduce emissions; transform the availability and cost of clean energy technologies manufactured in the US; and to spur the growth of US domestic companies and the green economy in the face of significant competition. The IRA, in tandem with tightening restrictions on clean energy technologies sourced from China, also has the potential shift the green technology value chain.

- What comes next: The IRA faces significant challenges in transforming low carbon value chains and meeting its policy objectives. Additionally, if Trump wins a second term in November, it is likely that he will rollback or impede implementation of key IRA provisions and delay US emission reduction goals.

ANALYSIS

The IRA faces several key obstacles that will moderate or slow the accomplishment of policy objectives, including: (1) competition with allies, (2) reliance on Chinese suppliers, and (3) emissions reduction calculations based on the widespread use of technologies that have not been tested at scale.

- The IRA’s focus on domestic industry put the United States on a competitive footing with allies at a time when cooperation is required to reduce emissions. For instance, tensions between the US and EU are particularly high around the exclusion of European companies from the IRA’s subsidies and tax benefits, and Europe is still crafting a response to US industrial policy implemented in recent years to spur domestic growth in their own strategic industries.

- Chinese suppliers remain key to the value chains of many products, including EVs and solar panels, and diversification options are scarce in many cases. In recognition of this issue, the Biden Administration released final rules regarding EV tax credits in the IRA that gave automakers some flexibility around some Chinese suppliers. In other areas, they are phasing in some restrictions on Chinese sourcing - such as in critical mineral processing - and utilizing other tools, such as tariffs, to further encourage US-based production.

- Finally, meeting the sweeping emissions reduction goals included in the IRA will require rapid scaling of emerging technologies and industries, such as hydrogen and carbon sequestration. Such high-risk investments may ultimately yield significant emissions reductions but reliance on this outcome may cause emissions to exceed policy objectives.

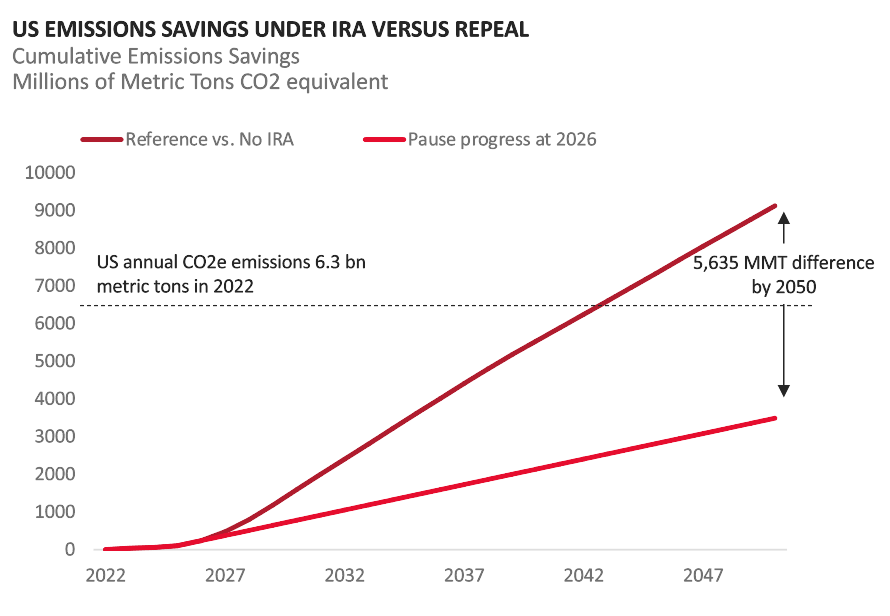

Against this backdrop, the potential re-election of Donald Trump is likely to result in significant curtailment of key IRA provisions. In particular, Trump and his allies have expressed interest in restricting EV consumer tax credits and rolling back federal funding for lower carbon energy projects. Rollback of the IRA would put net zero by 2050 out of reach for the United States and push back the impact of the energy transition spurred by the IRA by 10 years.

Topics: North America, Infrastructure, Industrial

Written by Onyx Strategic Insights