Search our articles

What lies ahead for Indonesia’s manufacturing sector?

Key Insights:

- What is happening: Indonesia's manufacturing sector has faced declining growth in recent years. The country's new president, Prabowo Subianto, has appointed a 109-member Cabinet tasked with addressing the recent contraction in the manufacturing sector.

- Why it matters: Facing labor shortages in Vietnam, companies are looking elsewhere in Southeast Asia for sourcing options. Indonesia sought to seize this opportunity with its 2020 Job Creation Law, aimed at simplifying business regulations and labor laws. However, regulatory overlap, limited administrative capacity, labor protests, and unclear incentives have limited its effectiveness, making Indonesia less competitive for manufacturing investments.

- What happens next: Indonesia has the potential to attract manufacturing investments due to its large, cost-competitive labor force, but success hinges on the new government’s commitment to implementing the Job Creation Law effectively. There are few indications that Subianto’s new administration will shift its strategy of prioritizing mining downstreaming.

ANALYSIS

The state of play of Indonesia’s manufacturing sector

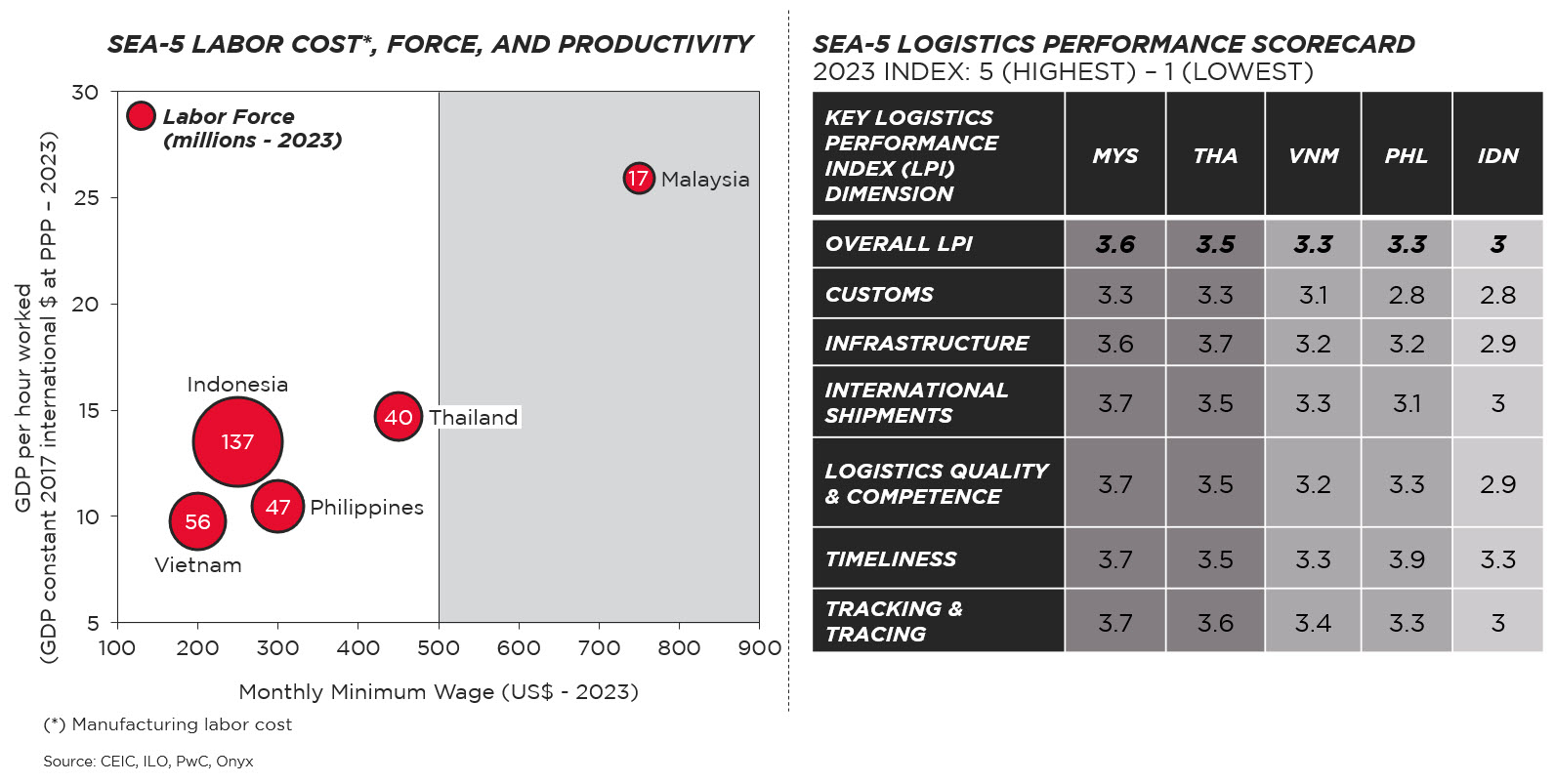

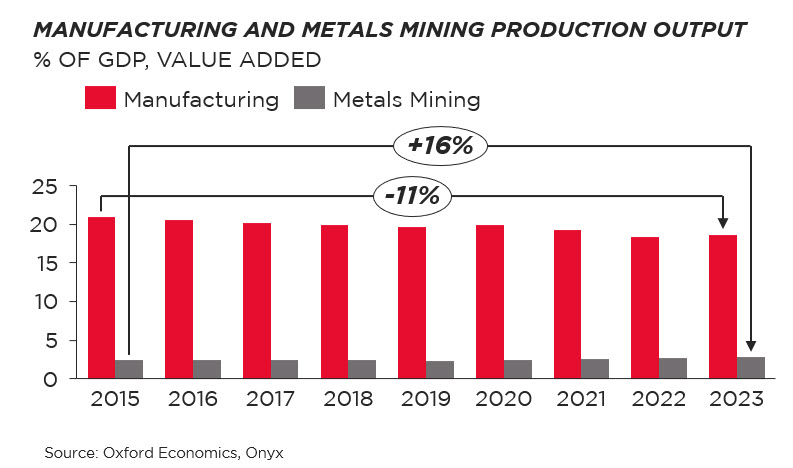

The manufacturing sector is a cornerstone of Indonesia's economy, however, its share of value-added output has declined in recent years. The country’s business environment is hindered by a complex regulatory environment, limited labor productivity, infrastructure constraints, and high production costs due to relatively high logistics expenses. These challenges have reduced Indonesia's competitiveness compared to other Southeast Asia-5 (SEA-5) nations. Subianto has indicated that he is seeking to address concerns over the weakening of the country’s manufacturing sector.

Indonesia’s efforts to boost manufacturing are not prioritized

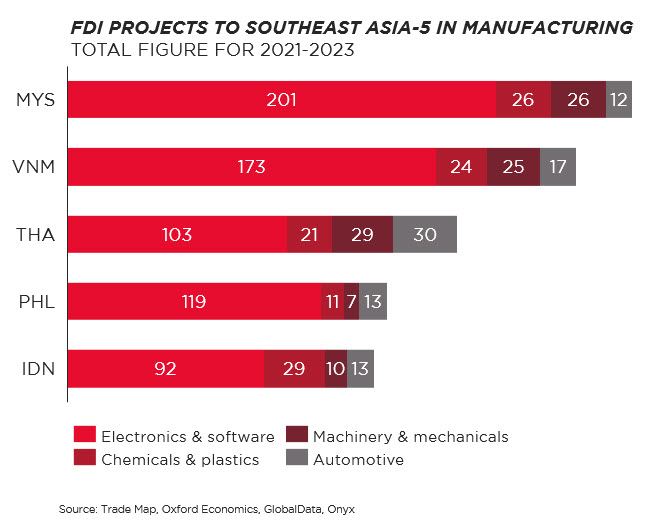

With labor shortages affecting Vietnam, companies are seeking alternative sourcing options within Southeast Asia. Past efforts to capitalize on de-risking strategies in Indonesia, such as the Job Creation Law in November 2020, sought to streamline regulations and attract investment across sectors, particularly in manufacturing. Despite these measures, challenges such as regulatory overlap, limited administrative capacity, labor protests, and unclear incentives for foreign investors have hindered the law’s implementation.

A key factor under the prior administration was a focus on other investments, a focus that continues under Subianto. The mining industry has received significant political support, particularly under the administration of Joko Widodo, which emphasized "downstreaming"—a policy prioritizing the local processing of raw materials to capture greater value. This strategy, especially focused on nickel, aims to boost the value of nickel products and build a robust EV battery supply chain, driving increased metals and minerals production in Indonesia.

This approach diverges from that of neighboring countries like Vietnam, Thailand, and Malaysia, which have strategically attracted manufacturing investments from companies seeking to diversify their supply chains away from China. These strategies have allowed Vietnam, Thailand, and Malaysia to capture more foreign investment in the manufacturing sector.

Looking ahead

Downstreaming the mining sector—particularly nickel—will remain a priority for Indonesia. Beyond nickel, the Indonesian government is also accelerating downstream efforts in the copper and tin industries. Alongside mining, the government is advancing downstream projects in the agricultural sector, aiming to produce bioethanol and biodiesel from sugarcane, corn, and palm oil.

Indonesia still has an opportunity to attract manufacturing investments, thanks to its large labor force and competitive labor costs compared to Malaysia, Thailand, and the Philippines. However, realizing this potential depends on the new government and its commitment to effectively implementing the Job Creation Law. Onyx’s review of policy materials provided by the new administration found few proposals likely to alter the direction of the country’s strategic positioning, however. Companies looking for alternative investment destinations in Southeast Asia will find relatively limited government focus on attracting manufacturing investment.

Topics: Southeast Asia, Labor, Industrial, Manufacturing

Written by Onyx Strategic Insights