Search our articles

China Navigates Economic Challenges to Spur Growth

Key Insights:

- What happened: Short- and long-term factors such as demographic, policy, and external headwinds are causing a deceleration in China’s growth.

- Why it matters: With old growth drivers faltering and household consumption failing to emerge, China seeks to expand production capacity in strategic emerging industries (SEIs) as a new pathway to growth. An expansion of Chinese value-added production means domestic firms will become increasingly competitive, pushing out foreign players in local sectors while expanding abroad to take up market share.

- What happens next: The rate of increase in China’s production capacity will struggle to keep pace with sluggish local and global demand, raising concerns about excess capacity. This issue will remain a persistent source of tension in China’s ties with its trading partners, notably the US and the EU, and complicate the competitive environment for Western companies competing directly against SEIs.

ANALYSIS

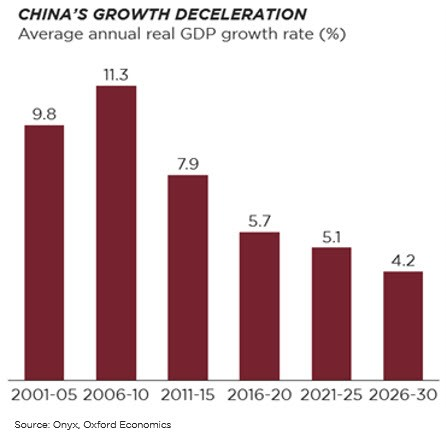

China’s growth has steadily slowed over the past decade and is expected to continue decelerating due to structural headwinds. On one hand, China faces demographic and maturation challenges, as the population and labor force are projected to decline 3.1% and 1.2% respectively over the next decade. This is compounded by a downshift in productivity rates by about half from 6-10% in 2010 to 2019 to 3-5% from 2023-2030.

Policy priorities and a tougher geopolitical landscape are also posing challenges to growth. Deleveraging reforms to the property sector have been accompanied by a sharp decline in residential home prices, cutting into household wealth and dragging down private consumption, a setback to Beijing’s goal of shifting China to a consumption-led economy. Heavily indebted developers have gone underwater, with reverberations over building materials firms, financial institutions, and employment of recent college graduates. Heightening competition with the US and EU, including punitive measures on Chinese exports and access to technology have dried up foreign investment.

With old growth drivers punching below their weight and the transition to a consumption-led growth model at a standstill, China has turned to expanding production capacity in SEIs. In late 2023, a state asset manager, China Reform Holdings Corp, pledged an SEI fund worth at least USD$13 billion, in addition to extant investments in these sectors since the establishment of the 13th Five Year Plan in 2016.

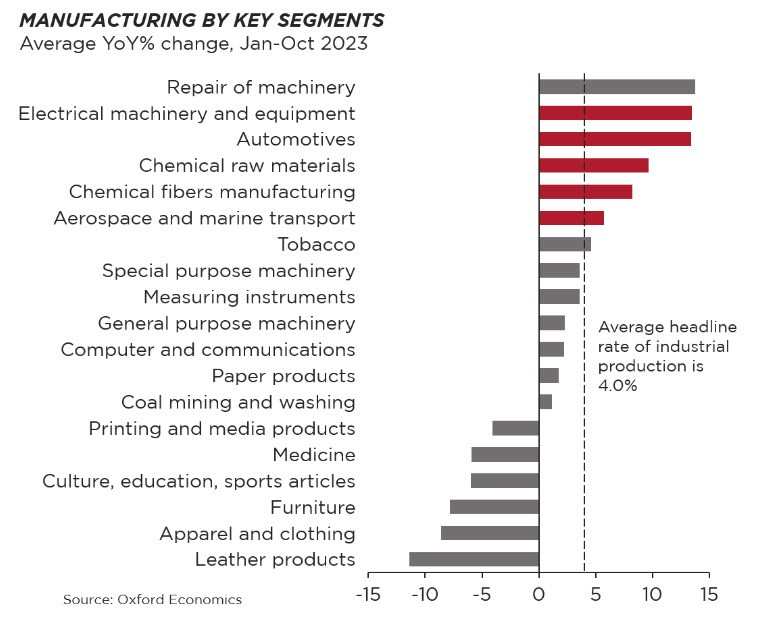

Investment in the SEIs is expected to help China meet its national security needs for domestic substitution, hedge against future punitive measures from the US and the EU, and position China more favorably in the ongoing geostrategic competition with the West. Early results seem promising – from Q1 to Q3 2023, China progressed in high-end manufacturing such as aerospace and medical and surgical equipment, while lower value-add sectors suffered.

However, success across high-end sectors is mixed. While China overtook Japan as the global top auto exporter last year and dominant market share between 80% and 96% in polysilicon, wafers, solar cells, and solar panels in 2023, its chip sector continues to struggle. Less than 20% of national demand is to be met by China-located production by 2025, and this includes foreign firms.

Yet, the rapid expansion of China’s production capacity has not yet been matched by requisite local demand, especially in the green sectors. China’s gigafactory pipeline for lithium-ion cell batteries, for example, is projected to be twice the capacity required to convert China’s entire vehicle fleet to battery electric vehicles by 2030. In response, Chinese firms have ramped up exports and plans to expand to international markets.

Expansion of production capacity in the SEIs may lead to additional tensions with the US and Europe, including:

- A challenging competitive environment for Western companies operating in China, given Beijing’s localization and national security priorities;

- Competition among Western and Chinese firms for market share in international markets;

- Tensions around China’s growing trade surplus, potentially compounded by perceived dumping in sectors such as low-end chips.

Topics: Asia, Industrial

Written by Onyx Strategic Insights