Search our articles

China’s export pivot to developing countries will be increasingly challenged

Key Insights:

- What is happening: In anticipation of rising trade barriers from developed economies, Chinese companies have been diversifying their exports and foreign direct investment (FDI).

- Why it matters: Rising concerns about Chinese exports are likely to create barriers to trade for companies that have sought to relocate from the Chinese market in the name of de-risking but that remain reliant on Chinese inputs.

- What happens next: China's shift towards generating revenue from developing markets will face growing obstacles, including the increase of trade barriers and heightened scrutiny from the US.

ANALYSIS

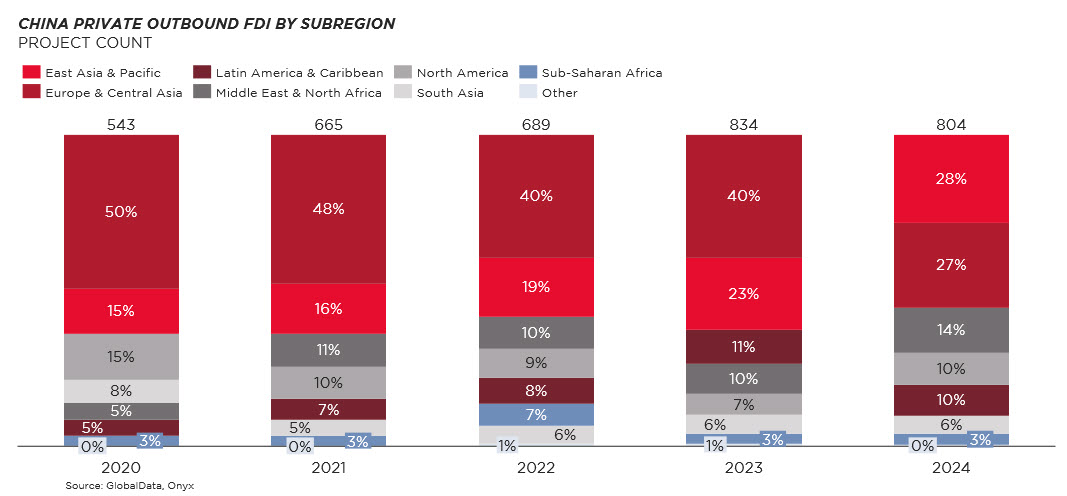

The export environment for China has kicked off to a bumpy start in 2025, as President Donald Trump levied 10% tariffs on Chinese goods, revoked and then temporarily reinstated de minimis privileges for low-value Chinese shipments into the US. While Trump’s opening volley has been impactful, the degradation in trade ties between China and developed markets is a secular trend driving Beijing’s ongoing pivot to emerging markets. Correspondingly, Chinese exporters are diversifying their investment geographically, with private outbound FDI increasingly flowing to Latin America and the Middle East & North Africa. The geographic shift in investment is particularly pronounced in the past 2-3 years, as Chinese firms pre-empt an expected rise in trade restrictions in the West.

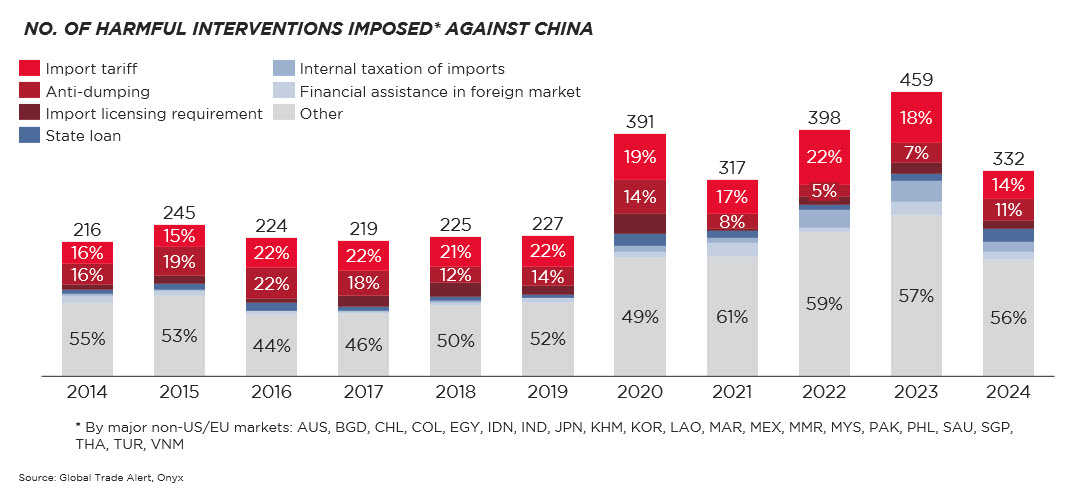

However, China’s pivot to seek revenue from developing markets will be increasingly beset by challenges such as the rise of trade barriers against Chinese goods and investment in the Global South as well as Western scrutiny of trade diversion. Key developing markets have levelled more harmful restrictions against China in the past few years, with a sharp uptick around the pandemic when China’s export pivot to the rest of the world accelerated. These primarily took the form of anti-dumping investigations and import tariffs.

The rise in trade restrictions on China is likely to persist. The Trump administration signaled its interest in cracking down on China’s rerouting of goods through third countries for further export to the US. The president’s attention has thus far been focused on Mexico and its auto industry but will likely extend to other trading partners. From 2017 to 2022, the decline in China’s share of the US market was compensated by an increase in Southeast Asia, Taiwan, EU, Mexico, India, and Korea’s market shares. Since the administration’s goal is to reduce the overall US trade deficit, the fact that major US trading partners have benefited from a drop in Chinese exports will draw retaliation from Washington. Thus far, this mainly constitutes anti-dumping, anti-subsidy, and anti-circumvention investigations that result in corrective duties. However, the Trump administration could also leverage threats of import tariffs and renegotiation of existing trade agreements to compel third countries to raise their own trade barriers against Chinese goods as conditions of access to the US market.

China’s pivot to developing markets will also be challenged by rising domestic protectionism in these economies. Since the pandemic, Chinese exports of steel, automotives, textiles, furniture, and ceramics have all come under scrutiny from Latin American and Southeast Asian governments. Both regions will likely wield import tariffs surgically, defending against the inflow of low-value goods and commodities, while allowing Chinese intermediates that are needed for domestic manufacturing to enter. These competing priorities will be a key constraint on the ability of developing markets to impose trade barriers on China. At the same time, emerging markets are likely to push for more Chinese investment in industrial technologies and infrastructure rather than just exports, driving the localization of Chinese companies in these economies.

Topics: China, Southeast Asia, North America, South America, Europe, Middle East, Trade, Politics, Manufacturing

Written by Onyx Strategic Insights