Search our articles

How China’s response to a second Trump administration may impact supply chains

Key Insights:

- What is happening: China reportedly signaled it will respond more strongly to incoming trade measures from the Trump administration.

- Why it matters: China’s toolbox to retaliate against punitive American trade measures have grown more sophisticated and proven since 2018.

- What happens next: Understanding the scope of these tools and the most exposed products allows multinationals to undertake contingency planning in a potential second US-China trade war.

ANALYSIS

Electoral promises by the Trump administration to impose 60% tariffs on all Chinese imports to the US should be taken seriously. Trump’s appointment for the Secretary of Commerce, Howard Lutnick, further confirms his intention to push through a punitive tariff and trade agenda on China. Trump may also agree to concessionary purchase agreements with China as part of a transactional deal to reduce the bilateral trade deficit. Since his electoral win, Beijing has telegraphed through official and non-official channels that it intends to respond more strongly to the tariffs imposed by a second Trump administration. We examine the various policy tools that China could retaliate with and highlight products vulnerable to restrictions in a second trade war.

Since Trump first imposed tariffs on China in 2018, China’s toolbox to respond has grown more sophisticated and proven. During the Biden administration, China demonstrated the effectiveness of its leverage over American firms who source in China. On one hand, this leverage stems from the reality that China is a major share of US imports across many industries. On the other hand, more precise legislation like the Anti-Foreign Sanctions Law and Unreliable Entity List gives China the ability to target specific firms it views as contravening its interests. For example, China sanctioned the US dronemaker Skydio under its Anti-Foreign Sanctions Law this year – the first time the law was used since its creation in 2021. China restricted the export of key battery inputs to Skydio following the firm’s lobbying for the blacklist of Chinese drone firms in Washington. This demonstrates that China is increasingly willing to reach for leverage over sourcing and able to punish select firms without implicating its overall export revenues by applying broad tariffs.

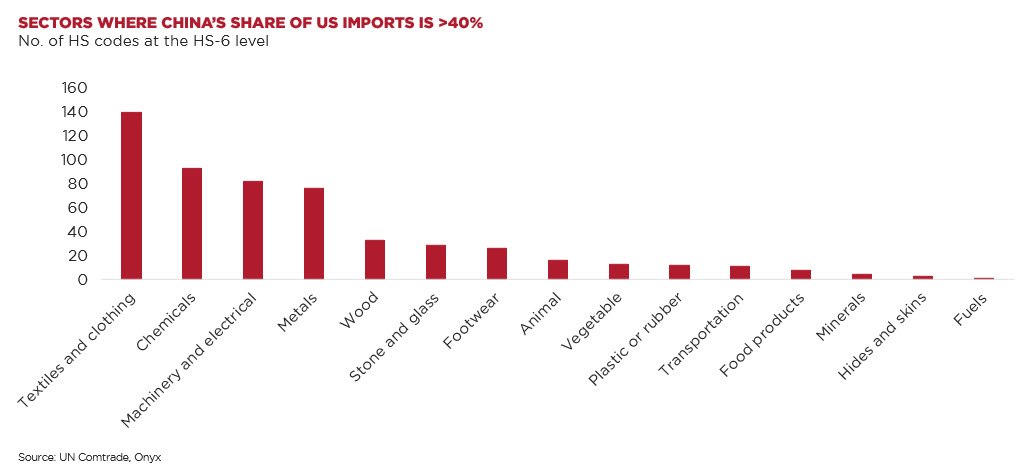

Assessing whether the US is a net importer of a given good and whether China accounts for a large import share of that good allows us to narrow down the products where China is likely to apply trade restrictions. Based on these two criteria, China possesses the most leverage over US imports of textiles, chemicals, machinery, and metals, the latter three of which are key inputs into pharmaceutical, tech, and capital goods supply chains. China has already restricted exports of some goods identified in our list, namely antimony oxides, graphite, molybdenum, and phosphates.

Additionally, China could accede to a concessionary trade deal with the Trump administration, similar to the Phase One agreement. This potentially includes committing to purchases of American goods that are monitored on a much closer basis than Phase One, particularly in agriculture where Chinese buyers still account for a large share of revenue. In contrast, we do not believe that the Trump administration will push Chinese firms to invest and produce in America; a stark contrast to the strategy the EU has taken in response to incoming Chinese exports. Trump has been vocal about scrutinizing Chinese ownership of infrastructure in the US and Chinese manufacturing in Mexico. Therefore, it is unlikely Trump will accept Chinese production in the US in exchange for a reduction or exemption to the tariffs. The degree to which China fulfils any promises to buy American goods in a deal with Trump will determine the longevity of any détente in the US-China trade relationship.

Topics: China, North America, Trade, Politics

Written by Onyx Strategic Insights