Search our articles

How might the Southeast Asia-5 respond to Trump’s tariff policies?

Key Insights:

- What is happening: The Southeast Asia-5 countries—Indonesia, Malaysia, the Philippines, Thailand, and Vietnam—face the potential impact of broad tariffs ranging from 10-20%, as well as additional targeted measures aimed at reducing the trade deficit or forcing negotiations.

- Why it matters: In recent years, companies have been diversifying their supply chains away from China and into one or more Southeast Asia-5 countries; however, the tariffs could disrupt these “China+1” strategies.

- What happens next: Policy discussions in the Southeast Asia-5 focus on potential concessions to the Trump administration, as the countries have limited leverage, and the US appears willing to accept higher import costs.

ANALYSIS

10-20% tariffs targeting the Southeast Asia-5

The Southeast Asia-5 (SEA-5) countries find themselves at a pivotal moment as they contend with the potential economic fallout of tariffs introduced by the Trump administration. These wide-ranging measures, imposing tariffs of 10% to 20%, along with targeted actions aimed at narrowing the US trade deficit or forcing negotiations, present substantial challenges for the region.

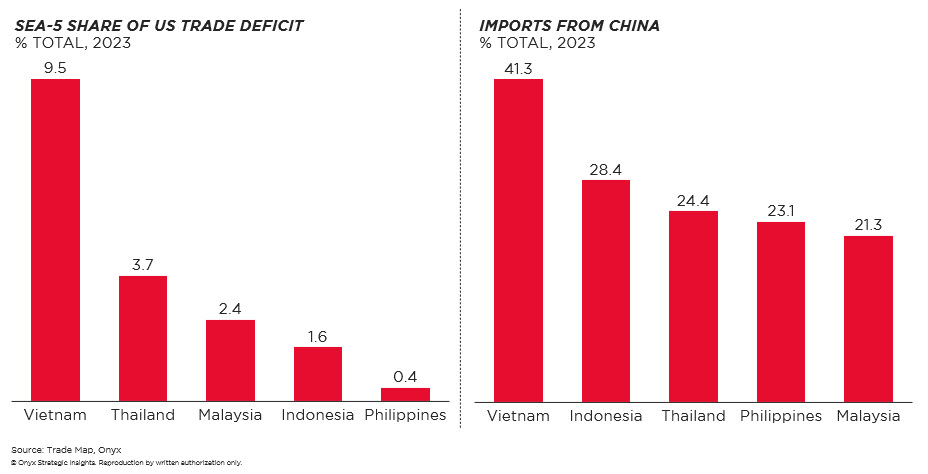

Among the SEA-5, Vietnam holds the largest share of the US trade deficit. Examining its trade structure reveals that more than 41% of Vietnam's imports originate from China, with most consisting of intermediate goods used in the assembly of products destined for the US. This trade pattern raises concerns about trade diversion, where Vietnam is perceived as a transit point for Chinese goods before their ultimate export to the US.

Businesses’ China+1 strategy could get disrupted

The diversification of supply chains away from China—often referred to as the "China+1" strategy—has been a defining trend in global trade over recent years. Businesses seeking to mitigate risks associated with over-reliance on a single country have turned to the Southeast Asia-5 as viable alternatives. Countries like Vietnam, in particular, have seen a boom in foreign direct investment (FDI) as multinational corporations establish production hubs to take advantage of lower costs and strategic geographic positioning.

However, the new tariffs could derail these strategies. Higher import costs in the US may make goods from Southeast Asia less competitive, reducing the appeal of relocating operations to the region. This scenario could lead to a slowdown in the diversification of supply chains, leaving businesses scrambling to reassess their strategies.

Concession or retaliation?

Faced with these challenges, the Southeast Asia-5 are adopting a concessionary approach. Policymakers recognize their limited leverage against the US, which is willing to absorb higher costs for imported goods. Instead of escalating tensions with retaliatory measures, these nations focus on negotiation to maintain stability. This pragmatic stance stems from their export-dependent economies and the need to preserve US market access. Additionally, policymakers aim to avoid trade disputes that could deter foreign investment and hinder economic growth.

Vietnam, in particular, avoids significant retaliatory tariffs due to its reliance on US investment and imports. The country prioritizes protecting its technology sector while managing pressure to reduce Chinese inputs and increase US purchases under higher baseline tariffs. Vietnam is likely to pursue a swift resolution with minimal concessions, while the US is expected to offer exemptions for companies diversifying from China.

Topics: Southeast Asia, North America, Trade, Politics

Written by Onyx Strategic Insights