Search our articles

Increase in e-commerce goods from China prompts scrutiny in the US and Europe

Key Insights:

- What’s happening: The rapid growth in e-commerce flows from China to the US and Europe is prompting intense scrutiny from policymakers. New restrictions may soon come into force.

- Why it matters: Changes to de minimis rules and other restrictions on Chinese e-commerce companies, if successful, could help reduce strains in the air freight market, where e-commerce goods are taking ever more capacity across Asia outbound.

- What comes next: The US Congress is considering several de minimis changes before the November election. The most likely outcome is an end to de minimis for goods subject to Section 301 restrictions. European policymakers are weighing several restrictions which likely won’t significantly reduce e-commerce imports. China’s e-commerce boom, the resulting turmoil in air freight and a host of other concerns will likely attract further scrutiny and the policy environment should continue to be monitored.

ANALYSIS

E-commerce growth has changed the landscape of low-value shipments

There is a booming market for direct-to-consumer e-commerce products being sold from China to customers in the United States and Europe, much of which is sent to end markets using de minimis exemptions. This increase in small packages has resulted in rate increases and capacity constraints in air and ocean freight markets that have raised prices for traditional importers across industries.

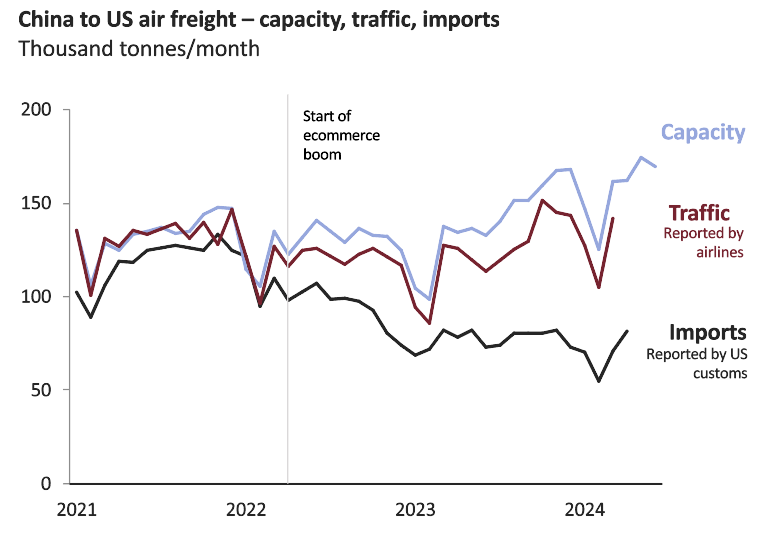

Growing gap in reported volumes of air cargo vs customs imports shows extent of e-commerce growth

De minimis exemption allows roughly 50,000 tons of e-commerce goods – a third of US air imports – to fly under the radar.

US Policymakers are oriented towards action, likely before the election

Policymaker concerns about de minimis and eCommerce are based on two key drivers: 1. The use of de minimis packages to aid in the flow of fentanyl into the United States which has triggered an ongoing public health crisis, and 2. As part of a broader trend towards addressing geostrategic competition with China. Both the White House and Congress have put forth proposals on the issue including reforms to the amount of information importers are required to provide to Customs and Border Patrol (CBP), exclusion of any goods subject to Section 301 investigations from the rule, and revoking China’s ability to ship goods via de minimis all together.

House Speaker Mike Johnson (R-LA) has indicated that de minimis reform tailored to goods that fall under Section 301 is likely to be included as part of broader China-related legislation at the end of September that will also include outbound investment screening requirements. This legislation is likely to be signed into law by President Biden before he leaves office. If the bill only addresses Section 301-related goods, it is unlikely to have enough of an impact on reducing e-commerce shipments to in turn free up capacity and bring rates down in the air market because many goods that fall under that tariff regime would be subject to tariff rates ranging from 7-25%, resulting in a cost increase that wouldn’t meaningfully impact their sales.

While the issue is fairly bipartisan, Democrats have raised concerns that the bill does not go far enough to restrict de minimis loopholes and it is likely that further changes will be proposed in a Harris or Trump administration and in the next Congress given broad political interest in countering China.

Europe pushes several restrictions on Chinese ecommerce goods

European policymakers are also taking aim at ecommerce from China as imports have surged in recent months – prompting a backlash from traditional retailers and concerns about sustainability, forced labor and consumer protection.

Several measures should be approved and implemented in the coming months. The regulations will add costs to Shein’s and Temu’s operations but likely won’t do much to reduce volumes in the medium term.

- Dropping tax exemption on low-value parcels: The EU’s current de minimis exemption allows parcels valued under €150 to avoid duties. In September, the Commission plans to call for removing that tax break and applying tariffs of 5-17%.

“Those rates likely aren’t high enough to reduce ecommerce imports. The move may also become wrapped up in broader customs modernization efforts, so the timeline for imposing tariffs could extend into 2025 or beyond.”

— Onyx Strategic Insights

- Regulating Temu and Shein under the Digital Services Act (DSA): Both applications have recently been designated “Very Large Online Platforms” and will face new compliance rules from September. These include detailed external audits and risk assessments designed to restrict the sale of illegal products like counterfeits, banned chemicals and dangerous toys.

“Fines for non-compliance could reach 10% of each company’s global turnover. But fines are unlikely to be imposed at that level anytime soon. The move is unlikely to severely restrict e-commerce giants’ operations.”

— Onyx Strategic Insights

- Forced labor ban: In April, European lawmakers approved a ban on goods made using forced labor – a move aimed at China and especially at China’s e-commerce giants. The burden of proof will lie with the customs authority rather than the importer, and the ban isn’t set for implementation until 2027. The United States’ much stricter Uyghur Forced Labor Prevention Act (UFLPA) hasn’t succeeded in stemming the flow of e-commerce imports, so the EU’s version may not make a big dent on its own.

Topics: Europe, North America, Asia, Trade

Written by Onyx Strategic Insights