Search our articles

Reciprocal tariffs hit home: what’s at stake for Southeast Asia?

Key Insights:

- What is happening: Southeast Asia is feeling the heat from the United States’ new reciprocal tariff policy. The 90-day pause in the implementation of this new tariff policy leaves little time for negotiation.

- Why it matters: Southeast Asia’s competitive edge as a manufacturing hub—built on low labor costs, trade preferences, and strong logistics—is under threat from the U.S. reciprocal tariff policy, which raises production costs and weakens its position against economic rivals like India. In labor-intensive sectors such as apparel and footwear, even slight tariff increases can wipe out thin margins, risking factory closures, job losses, and widespread social impacts.

- What happens next: Southeast Asian countries cannot afford to lose access to the U.S. market, particularly in key sectors like apparel, electronics, and footwear. Behind-the-scenes negotiations or formal trade talks are beginning, with proposals for tariff cuts, improved market access, and strategic concessions.

ANALYSIS

The trade imbalance trigger

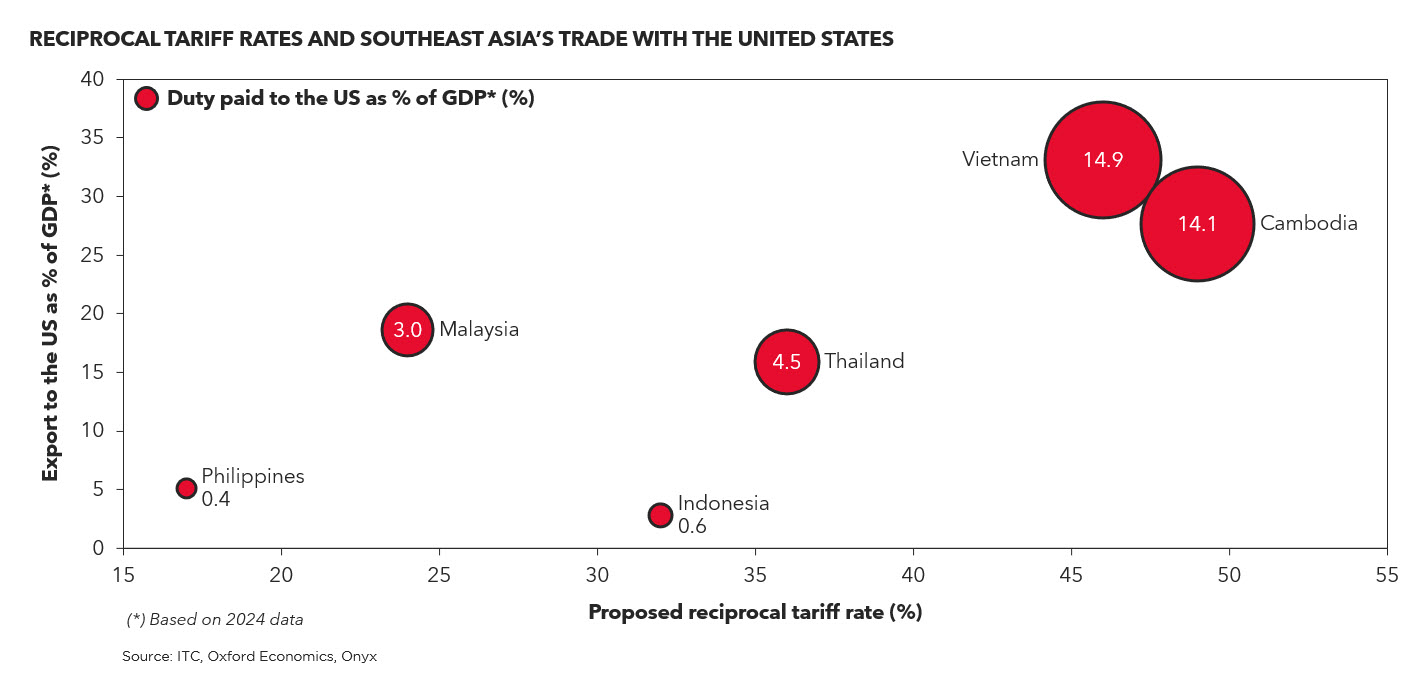

The United States’ new reciprocal tariff policy has stirred concern among Southeast Asian economies. Even with a 90-day pause before implementation, the policy is already shaking up trade expectations. At the heart of the issue is the U.S. trade deficit with six key Southeast Asian economies—Cambodia, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam (collectively, the SEA-6).

A closer look at the data reveals the stakes: Cambodia and Vietnam, whose exports to the U.S. form a sizable portion of their GDP, are especially vulnerable. In Cambodia, the apparel sector alone accounts for over 80% of goods sent to the U.S., while Vietnam is a key electronics and textiles hub. For both, higher tariffs mean higher costs—and potentially lost market share.

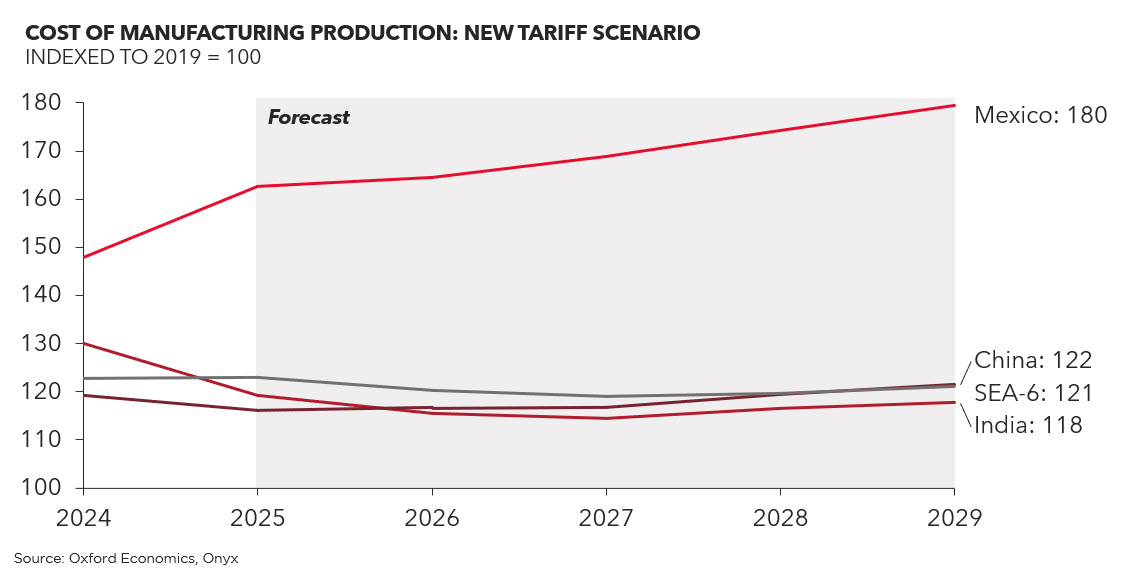

Reciprocal tariffs could erode SEA-6’s cost advantages

Southeast Asia’s emergence as a global manufacturing hub has been built on a straightforward value proposition: low labor costs, preferential trade tariffs, and efficient logistics networks. These strengths have made the region a magnet for international manufacturers, particularly in labor-intensive industries such as apparel, footwear, and furniture. The U.S. new reciprocal tariff policy threatens to erode this competitive edge and could eliminate already narrow profit margins in those labor-intensive sectors. Moreover, the new tariff could also increase manufacturing costs across SEA-6, making the region less competitive compared to India.

The fallout could extend far beyond the factory floor—export-driven industries in Southeast Asia are the backbone of economic stability for millions of people. A prolonged tariff dispute could trigger widespread factory shutdowns and layoffs. This could potentially spark social unrest or instability. Such dire socioeconomic consequences would pose significant challenges for governments, placing immense pressure on policymakers who cannot afford to risk such disruptions.

What happens next?

Businesses should expect quiet diplomacy and tailored concessions from the SEA-6, who understand that losing U.S. market access is not an option. Negotiations—formal or informal—are already in motion:

- Vietnam is eyeing a zero-tariff deal on select U.S. goods to safeguard exports and addressing transshipment issues.

- Cambodia has proposed a 5% tariff on 19 U.S. products, including agriculture, ethanol, and vehicles—signaling its willingness to negotiate despite limited leverage.

- Malaysia and Thailand may offer market access improvements in agriculture or services.

- Indonesia proposes to boost imports of U.S. crude oil and LPG while easing non-tariff barriers, including relaxing import quotas and local content requirements.

- The Philippines may focus on trade balancing to protect its BPO-driven, remittance-reliant economy.

These concessions are delicate balancing acts. While they may help maintain access to the U.S. market and avert steep tariffs, SEA-6 leaders must carefully protect national interests and shield vulnerable domestic sectors. At the same time, they must offer enough to satisfy U.S. demands. For businesses, closely monitoring each country’s negotiating strategy is key to identifying emerging risks and opportunities.

Topics: Southeast Asia, North America, Trade, Manufacturing, Politics

Written by Onyx Strategic Insights