Search our articles

Republican trade policy platform sets the stage for negotiations

Key Insights:

- What happened: The 2024 platform approved at the Republican National Convention (RNC) on July 15th supports a plan to remove China’s Permanent Normal Trade Relations (PNTR) status, develop a baseline tariff on all foreign-made goods, and create an automatic response mechanism to any tariffs placed on US exports.

- Why it matters: The platform as described would be a historic change in US trade policy and, by extension, macroeconomic policy. An Onyx macroeconomic modeling scenario shows the effects of the successful implementation of these policies would be wide ranging and recessionary. Countries facing these measures will seek to balance impacts to their economies and leverage in negotiations with the deal-oriented administration.

- What happens next: The platform – said to have been steered by the Trump campaign - may ultimately be a negotiation tactic by the Trump administration, but it will face significant hurdles in establishing credibility as Congressional control of both chambers remains heavily contested and majorities are likely to remain tight. What’s more, the structural realities of the targeted economies, particularly China, are likely to prevent a satisfactory negotiated settlement.

ANALYSIS

The 2024 RNC platform provides one of the clearest, most credible insights into the plans of a second Trump administration thus far in the campaign cycle. The platform aims to protect and grow domestic manufacturing, US job creation, and secure international supply chains. Trump is known for his maximalist approach to trade negotiations and the platform can be interpreted as an opening gambit to policymakers around the world.

The credibility of this approach in a possible second Trump term would depend on the composition of the House and Senate, due to their constitutional role in shaping trade policy. With a limited number of contested seats, majorities will be slim and subject to defections. The outcome of these races remains too close to call as Vice President Kamala Harris enters the race. In the event of a Republican sweep across the executive and legislative branches the possibility of implementation increases significantly, but the bipartisan appeal of trade actions against China and thin majorities may also support such efforts in the case of a split decision.

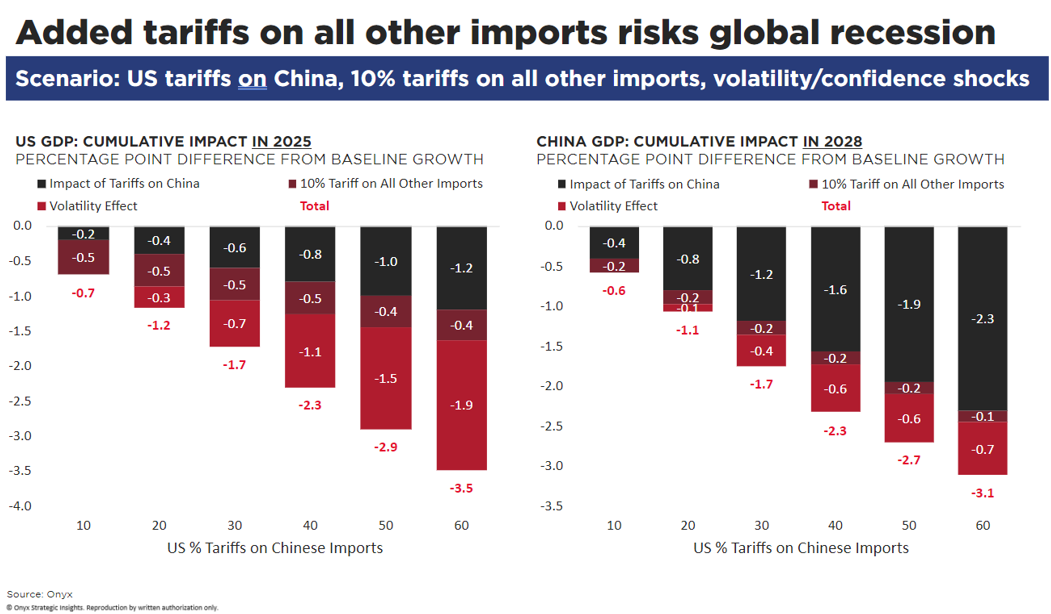

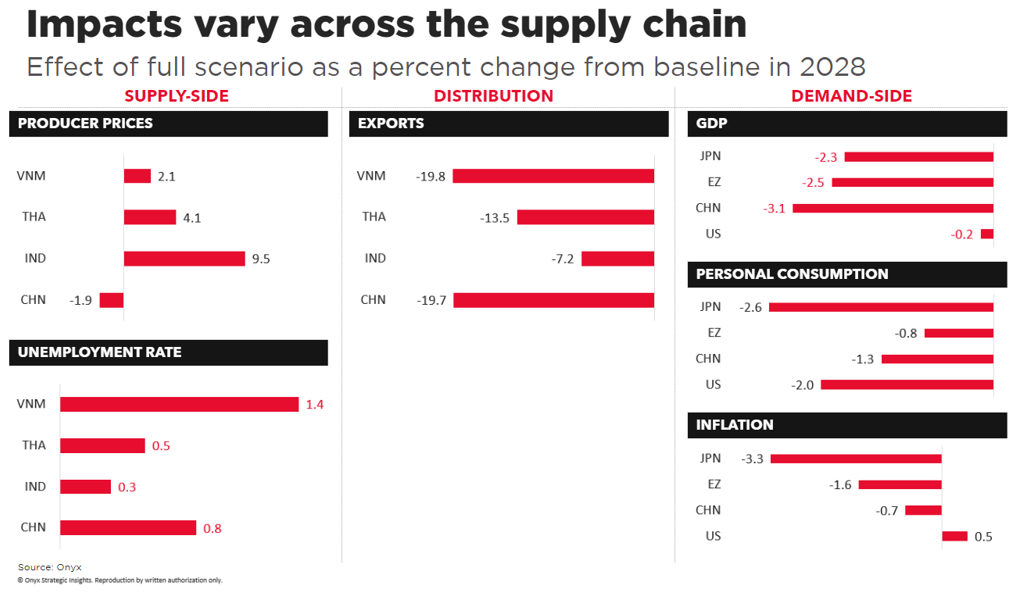

According to an Onyx macroeconomic modelling scenario, a global and domestic recession and is highly likely with the proposed combination of policies. The level of retaliation from other countries would be a key determinant of the scale of impact. In a new term, Trump would have several advantages including a credible track record of implementation and negotiation backed by the sheer scale of the US consuming market, likely limiting early-stage retaliation.

However, Trump would again face structural challenges in negotiations with key global trading partners as a country’s trade policy is intertwined with its broader political-economic underpinnings. China, for instance, is significantly limited in its economic policy options. The scale of reform required to meet the Trump administration’s demands to dramatically reduce trade deficits circumscribed the effectiveness of negotiations in his first term and continues to make a quick and satisfactory resolution difficult to envision.

Limited first-term impacts on the overall trade balance increase the appeal of extreme threats like PNTR removal and across the board tariffs for foreign-made goods. Such tactics may not result in negotiated settlements, however, and the actual removal of China’s PNTR legal status would be difficult to reverse. If PNTR removal were to proceed, it would have profound effects on the US economy and mixed impacts by industry. Such an action risks a high tariff and high retaliatory scenario in which the economic impacts would be profound for both producing and consuming countries, represented below.

Topics: North America, Trade, Politics

Written by Onyx Strategic Insights