Search our articles

Supply Chain Implications of Taiwan’s 2024 Presidential Elections

Key Insights:

- What is happening: Taiwan’s presidential elections will be held on January 13. Currently, the pro-independence candidate, Lai Ching-te, is leading in polls.

- Why it matters: The election touches upon two main issues: Cross-strait relations risking a new period of heightened tensions if election outcomes are perceived to boost independence, which in turn may lead to responses from Beijing affecting trade with the island or volumes going through the Taiwan Strait; and how best to tackle weak economic growth, including the pursuit of global investment opportunities and trade diversification.

- What comes next: The election outcome will influence the range of Beijing’s responses and the potential for further tensions, as well as the direction of the Taiwanese economy, including its semiconductor industry.

ANALYSIS

On January 13, Taiwan will head to the polls to select its new president amongst three candidates – Lai Ching-te from the incumbent pro-independence Democratic Progressive Party (DPP), Hou Yu-ih from the historically mainland-aligned Kuomintang (KMT), and Ko Wen-je from the Taiwan People’s Party, a new force aiming to provide an alternative to the two dominant parties.

Key election issues include cross-strait relations and strategies to boost weak economic growth in this election.

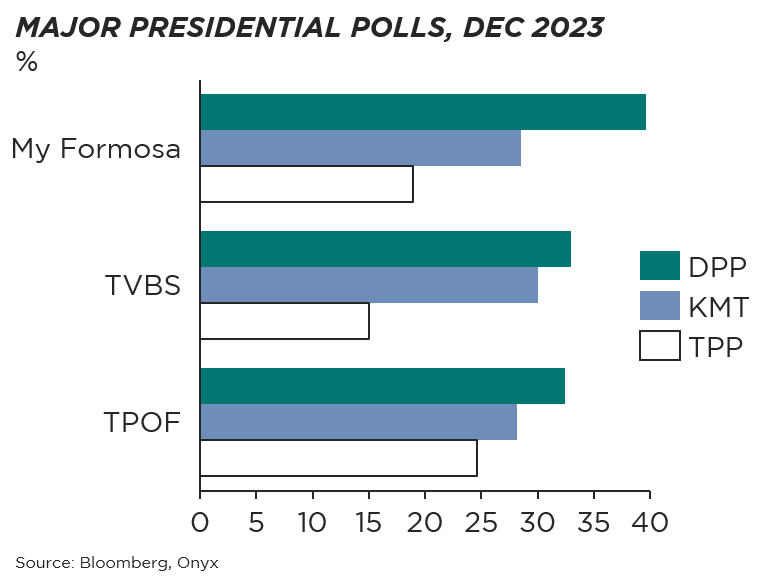

Latest polling shows that Lai is pulling narrowly ahead of Hou while Ko trails both figures. A three-way election fight between the KMT, DPP, and TPP will likely favour the DPP incumbent as pan-nationalist votes will be divided between the KMT and TPP. Evenly split support between the DPP and KMT means that whoever wins the presidential bid is unlikely to have a strong parliamentary majority, potentially capping their capacity to implement changes to existing policies.

The stakes are high – a continued DPP presidency may intensify PRC anxieties. Nonetheless, the odds of an outright Taiwanese declaration of independence, which is a major red line for Beijing, remain very low. The DPP and KMT candidates have pledged to uphold the status quo and the opposition will likely constrain a DPP president’s pro-independence policies.

POTENTIAL OUTCOMES

Potential reactions from Beijing

A reduction in trade of non-tech goods with the mainland – Beijing may suspend more preferential tax rates on Taiwanese imports and restrict select Taiwanese exports such as agricultural or non-tech goods. The mainland may also suspend the Economic Cooperation Framework Agreement (ECFA), a free-trade agreement (FTA) between Taiwan and the PRC. The ECFA suspension is however unlikely to materially reduce high tech Taiwanese exports to the mainland.

Increased pressure on potential and existing Taiwan FTA partners – Beijing will place pressure on the US, EU, Canada, and the UK to terminate existing FTAs or cease FTA negotiations with Taiwan. Changes to existing or upcoming FTAs will create trade compliance challenges for firms who are sourcing inputs from Taiwan for production in these markets.

Taiwan Strait movement disruptions – A further deterioration in ties means Beijing will ramp up the frequency and scale of military exercises in the Taiwan Strait, raising possibility of accidental escalation and movement disruptions for shipping vessels.

Taiwan’s economy

Dilemma over internationalization of Taiwanese firms – Diversification of Taiwan’s growth to other geographies is a major policy initiative for all three parties. However, this poses the dilemma of potentially eroding Taiwan’s strategic value as critical supply chains shift abroad to other locations. Taiwanese firms may seek to retain strategic business activities at home, such as R&D and production of cutting-edge chips, while expanding mid or lower tier manufacturing abroad.

Circumscribed government capacity to pass policy will limit Taiwan’s ability to remain central in global value chains – A divided government will delay the speed and scale of policymaking. This means Taiwan may struggle to coordinate policy with other countries enmeshed in semiconductor supply chains, such as the US, EU, Netherlands, Japan, and the UK. Beyond the chip sector, Taiwan’s emerging strengths in the life sciences and software sectors may be hampered by policy uncertainty around international partnerships, limiting its investment attractiveness.

Written by Onyx Strategic Insights