Search our articles

US Elections - economic policy signals from VP Harris

Key Insights:

- What is happening: Vice President Kamala Harris released her economic plan. The bulk of her investments are poised to impact services with a smaller investment in modernization of traditional industries alongside advanced industries.

- Why it matters: Harris did not directly address her position on tariffs but indicates an agreement on the role of trade policy in protecting industrial policy investments. The identified industries may give hints to where Harris will focus her attention should she take office.

- What happens next: With less than a month until the November election, this may be the most comprehensive look at Harris’ economic plans. Her focus on taxes will need to pass through a Congress that is potentially split and/or marred by slim majorities for either party.

ANALYSIS

Recap: industrial policy during the Biden Administration

The Biden administration’s notable focus on industrial policy included several pieces of legislation: the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act. The White House to date claims an estimated $900 billion in investment resulted from these and related policies with spending centred on infrastructure, semiconductors, and green technologies.

During the present administration, industrial policy was generally supported with tariffs, export controls, and other trade measures. The administration was particularly active in combining investment with complimentary trade actions in the semiconductor segment.

Timeline of major semiconductor industrial policy and trade actions

|

Date |

Description |

Policy Type |

|

May 2020 |

US bans sales of semiconductors to Huawei |

US export controls |

|

June 2021 |

Biden admin supply chain derisking report identifies semiconductors as a priority for the administration |

US policy proposals |

|

Aug 2022 |

2022 U.S. CHIPS & Science Act industrial policy |

US industrial policy |

|

Oct 2022 |

US Commerce imposes semiconductor export controls |

US export controls |

|

May 2023 |

China bans Micron chips in national infrastructure |

Chinese procurement restrictions |

|

July 2023 |

China’s Ministry of Commerce puts export restrictions on gallium and germanium |

Chinese export controls |

|

Sept 2023 |

Restrictions to CHIPS funding to prevent manufacturing within China |

US industrial policy exclusions |

|

May 2024 |

Legislation exempting semiconductor facilities from environmental reviews |

US regulatory change |

|

Sept 2024 |

Section 301 tariffs are expanded to include certain semiconductors |

US tariff expansion |

|

Oct 2023 |

Expansion of semiconductor export controls by Commerce |

US export controls |

Source: CFR, Department of Commerce, Onyx

VP Harris’s plan

In her proposal, Harris claims the major investments of the Biden administration were a key source of increased manufacturing employment, but the proposal does not include industrial subsidies that match them in scale. Instead, the plan is focused on expanding services such as education, daycare, and health care. The plan also features expansions of housing supply through the low-income housing credits and starter homes initiatives.

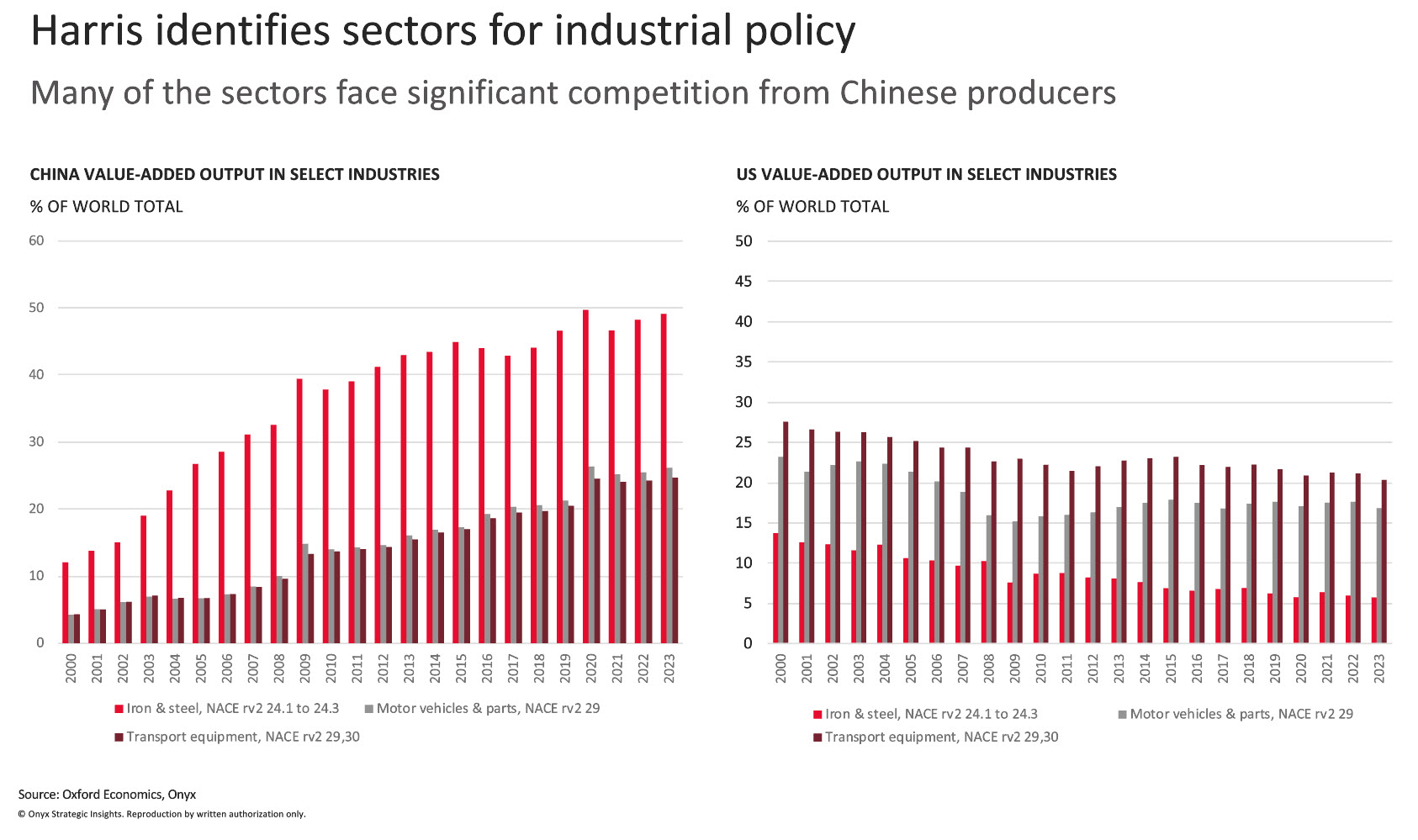

Nonetheless, Harris does not entirely eschew industrial policy with $100 billion in planned tax credits over a decade. The plan focuses on clean iron and steel, biomanufacturing, artificial intelligence, aerospace, data centers, and clean energy while also providing support to small businesses generally. She links these investments explicitly to national security concerns, fearing the US will “cede leadership to nations like China” without action.

Harris also notes that her administration will act when it perceives trade actions are unfair or that intellectual property is under threat. The plan specifically identifies shipbuilding and electric vehicles as two example areas. Both segments have already seen actions taken by the Biden administration with the expansion of Section 301 tariffs on Chinese electric vehicles and a shipbuilding investigation initiated earlier this year. Harris, who as a senator voted against the USMCA in 2020, has also called out the agreement as having made it “far too easy” for auto manufacturers to “outsourc[e] American jobs”.

Trump similarly plans to reshore US companies and attract foreign direct investment. Both candidates also prioritize the creation of jobs and supporting traditional industries, but the approaches are substantially different. Trump’s plan, which we previously covered after the Republican convention, is focused on a combination of across-the-board tariffs on foreign goods, tax incentives for US production, and business environment improvements.

While the Republican platform, guided by former President Trump’s team, provided significant details on trade policy proposals, Harris’s plan is vague regarding tariffs. Nonetheless, her plan mentions trade and intellectual property concerns as a part of her industrial policy. Both the Trump and Harris plans reinforce the conclusion that China will continue to be the focus of US trade policy regardless of the election’s emerging winner.

Topics: North America, Trade, Infrastructure, Industrial, Elections

Written by Onyx Strategic Insights