Search our articles

US-EU: farther apart

Key Insights:

- What happened: US-EU relations were rocked by threats of US tariff increases; criticism of EU tech regulations, immigration, and defense spending; direct US-Russia talks on the war in Ukraine; and challenges to the EU’s Green Deal.

- Why it matters: US actions represent not only a departure from decades of US-EU trade and security policy, but also growing US skepticism towards the EU itself – leading to mounting risks to EU institutions including the common market.

- What happens next: While there is still a plausible scenario for a more nuanced approach to trade and tariffs, much will depend on (i) US-EU discussions on trade relations, with the EU indicating potential concessions; (ii) results of US-Russia talks on Ukraine; (iii) the results of German elections on Feb. 23, and implied voter sentiment towards the EU.

ANALYSIS

A flurry of activity in the past week has brought US-EU relations to a historical low, with long-term consequences for trade, investment and security. Much of the attention focused on the budding alliance between the US and Russia, as well as US pressure on defense spending, tech and immigration. The moves signal a break with longstanding US policy towards European security towards closer alignment with Moscow. There are lingering fears of a pull out of US troops stationed in Europe, and security guarantees under NATO.

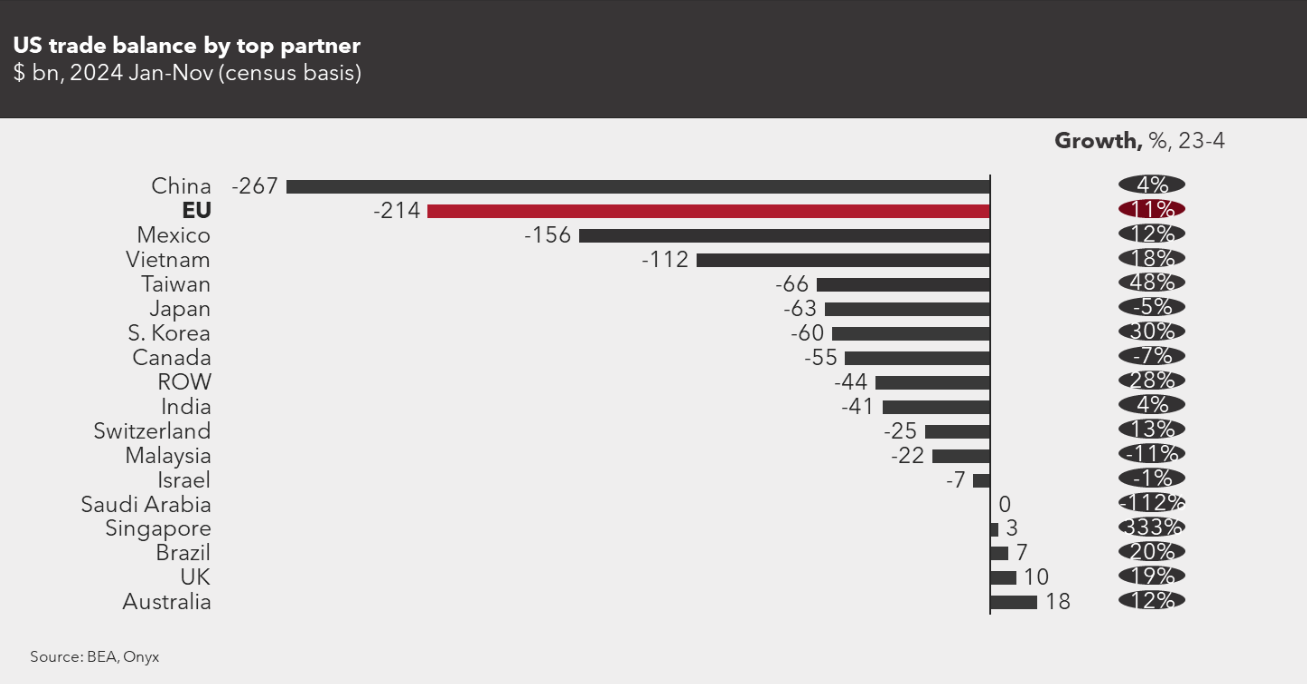

On trade, a potential deal seems plausible including not only auto tariffs, but also US demands on commodity exports. President Donald Trump has renewed threats of increased tariffs on the EU, under a principle of reciprocity that could upend the GATT’s most-favored nation (MFN) system and the WTO. The EU seems committed to a negotiated deal that would lower its existing 10% tariffs, provide for increased US energy imports, and foster a shared approach to China.

There is also increased likelihood that EU sustainability ambitions could be watered down, which could in the short term alleviate US concerns. The European Green Deal has also suffered increasing opposition within Europe, in particular delaying requirements on supplier compliance with environmental and forced labor regulations (the “due diligence directive”), and corporate sustainability reporting.

But while a stopgap deal and limited action on sustainability could alleviate US pressure, outstanding issues on trade deficit, defense, Ukraine and tech will likely result in continuing tensions. Europeans seem far apart still on defense spending, and unlikely to curb the Digital Services Act.

(goods only)

In the long run, however, it is the EU and its common market that seem most at risk. There is growing US skepticism towards the EU, including support for anti-EU movements. The economic crisis engulfing Germany – arguably the EU’s “connective tissue” – Euroskeptic movements, and weakness of pro-EU governments add to the picture. On the other hand, pressure has accelerated common defense arrangements, boosted ideas around a collective security mechanism beyond Europe, and reinforced a sense that the EU is still essential to Europe’s bargaining power on the global stage. Whether that will successfully check anti-EU sentiment is unclear; results of elections in Germany are a key signpost.

Topics: Europe, North America, Trade, ESG, Politics, Elections, National Security

Written by Onyx Strategic Insights