Search our articles

US readying additional trade and investment restrictions on China

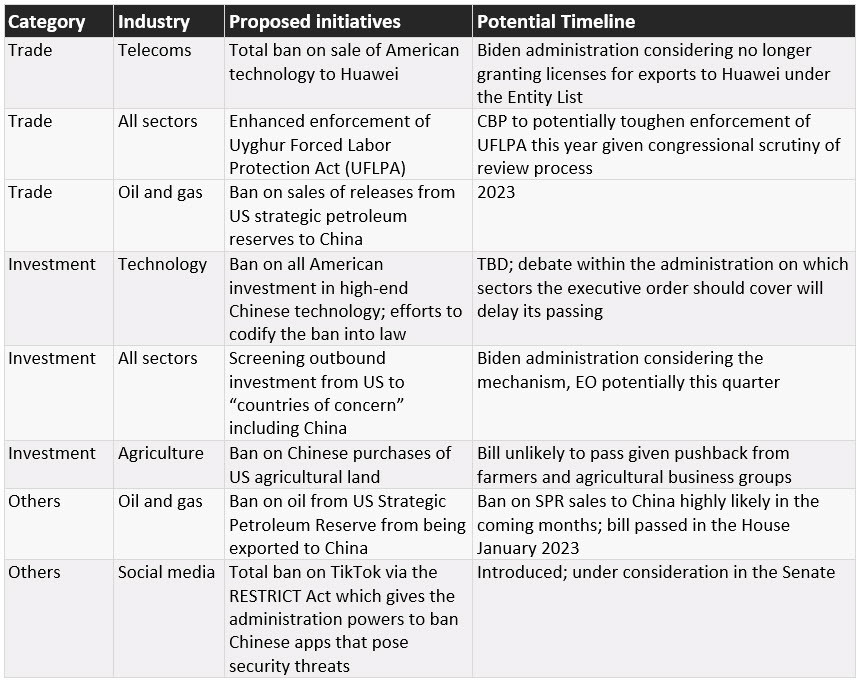

Following the extensive package of chip export controls on China last October, American policymakers are poised to implement at least nine restrictions on China in 2023 across six industries, ranging from telecoms to agriculture and oil and gas. We expect the pace and scope of US regulatory action on China to intensify in the coming months as US-China relations persist on a downward spiral. Strategic industries such as semiconductors and tech, or industries where China is dominant in are likely to be the target of scrutiny in Washington.

Semiconductors

The US government is considering additional restrictions that will add to existing political efforts to restrict Chinese access to semiconductors and shore up US supply chains. The Biden administration is widely anticipated to release a new Executive Order requiring outbound investment screening for sensitive technologies. Senate Majority Leader Schumer recently confirmed that Congress may seek to codify those efforts in legislation.

These restrictions are being considered as the Senate is readying the China Competition Bill 2.0. The package centers on five main areas: limiting the flow of advanced technologies to the Chinese government, boosting domestic economic investments, providing an alternative to China’s Belt and Road Initiative, limiting the flow of investments to China, and deterring action on Taiwan.

Solar Panels

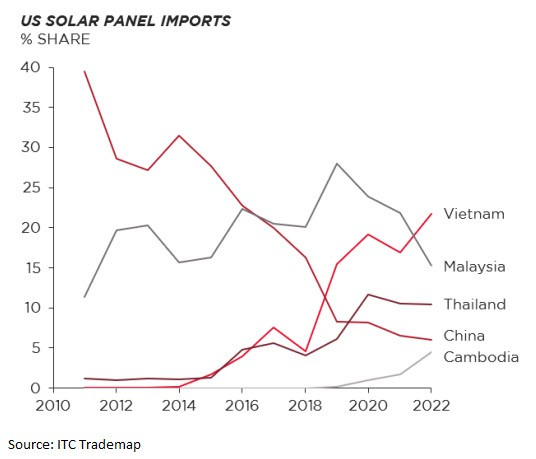

President Joe Biden vetoed a resolution by Congress to end a two-year pause on solar import tariffs from Southeast Asia in late May. This follows a Commerce Department investigation which preliminarily concluded that Chinese solar manufacturers were circumventing tariffs by routing products through Malaysia, Thailand, Cambodia, and Vietnam. Companies found circumventing or purchasing from Chinese suppliers will take on duty rates below 35%. However, if they cannot demonstrate a separation from the CCP, their duty could be over 200%.

Implications

While Biden has vetoed the resolution, efforts by Congress to undo the pause on the solar tariffs may set a precedent for similar attempts in other industries where Chinese firms are found to be routing products through Southeast Asia. Further US regulatory action could target industries where China faces tariffs or has a dominant market share, such as metals used in EV production (nickel, copper) or furniture.

Given China’s prominent role in the clean energy transition, Washington will increase its scrutiny of suppliers in the renewable energy, electric vehicle, green metals, and related sectors. Regulatory action in these industries will delay the pace of the energy transition as policymakers attempt to balance de-risking environmental supply chains from China and accelerating the buildout of green infrastructure.

Appendix: Summary of existing proposed initiatives

The US government continues to consider a variety of policy tools in both the executive and legislative branches to impose trade and investment restrictions on China, particularly in areas related to critical technologies such as semiconductors and renewable energy technologies such as solar panels. Incoming proposals include:

Topics: North America, Asia, Trade

Written by Onyx Strategic Insights