Search our articles

Will the US revoke Permanent Normal Trade Relations with China? Implications for Global Companies

Key Insights:

- What happened: Multiple presidential candidates have announced their intentions to revoke China’s permanent normal trade relations (PNTR) status. The measure is gaining support amongst Republican lawmakers.

- Why it matters: For multinational firms, revocation of PNTR would mean immediate tariff increases ranging from 19-61% thereby drastically increasing the cost of goods and inputs imported by the US from China.

- What comes next: The likelihood of revoking PNTR is low, given the broad potential fallout on the US economy, but it could serve as a door-opener for additional trade measures against China.

ANALYSIS

What is PNTR and will it be revoked?

PNTR is a legal status currently entitling China to the same favorable trade terms offered to other WTO members, specifically lower, nondiscriminatory tariffs. If implemented, the proposal to revoke China’s PNTR would increase the total average tariff applied to Chinese non-fuel exports. These increases are estimated to potentially range from 19% to 61% and the costs climb rapidly if China decides to retaliate with reciprocal tariffs.

Republican presidential candidates Donald Trump, Ron DeSantis, and Nikki Haley have expressed support for the measure. Meanwhile, the House Select Committee on the Chinese Communist Party (CCP), which is comprised of a bipartisan group of representatives, is due to release policy recommendations in late 2023 that may include revoking PNTR with China. Thus far, ranking members from both parties have not expressed disagreement with revoking PNTR, reinforcing a lack of outspoken opposition on both sides of the aisle.

The proposal is certain to face mixed reactions from analysts, policymakers, and companies, including resistance from China import-dependent industries. Some analysts have already estimated significant costs to the US economy, with US consumers bearing the brunt as consumer prices increase by an estimated 1.2% as a result. The projected cost to broad swathes of the US economy of revoking China’s PNTR status will be a major constraint on policymakers’ willingness to exercise this option.

Instead, lawmakers are more likely to use the PNTR issue as leverage to secure other measures that are aimed at reducing US-China trade. These include:

- Augmenting Section 301 and 232 tariffs on China;

- Adding goods to or raising existing tariff schemes on Chinese imports;

- Retaliation for perceived Chinese circumvention of US tariffs and other trade policy measures.

Potential impacts of revoking China’s PNTR status

Even as proposals to revoke PNTR are directed towards US-China competition, a few analysts have warned that doing so would deal significant costs to the US economy that are likely intolerable for policymakers, industry, and the public. Multiple studies by industry associations and think tanks have evaluated the potential impacts of re-classifying Chinese imports from Column 1 of the Harmonized Tariff Schedule, where it enjoys PNTR tariff rates, to Column 2, which entails higher tariff rates akin to those faced by Russia and North Korea. One of those analyses estimates that an increase in US tariffs alone – excluding any potential Chinese retaliation – would result in a $1.6t decline in GDP over a five-year horizon and the loss of approximately 700,000 jobs.

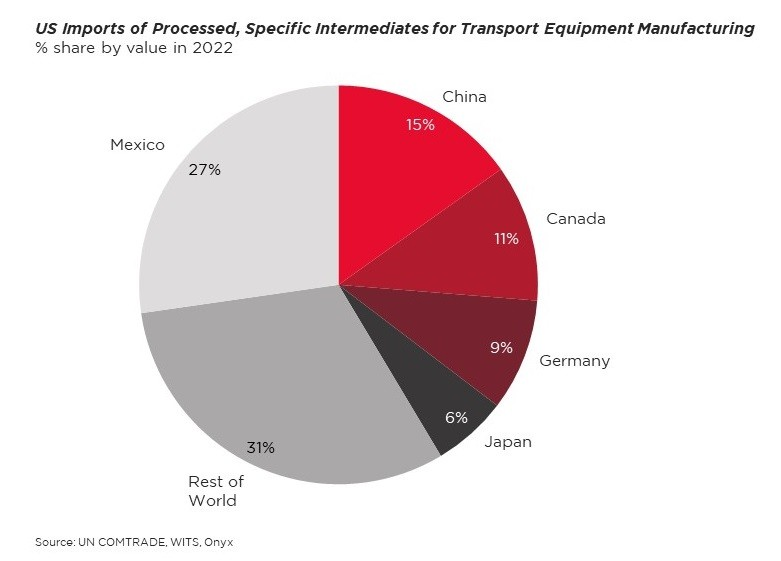

The impact on industry segments will be mixed, however, depending on the level of competition in contrast to dependence on Chinese imports. Motor vehicle manufacturing and other transport equipment (including ships, boats, aircraft, railway locomotives and rolling stock) manufacturing would be the worst-hit in terms of sectoral GDP. External estimates point to a potential cumulative 4% GDP reduction for the motor vehicles sector by 2025 and 2028, while the machinery sector will see impacts closer to 1-2% of sectoral GDP. These industries are especially reliant on inputs from China, including for specialized intermediates that would be difficult or costly to source from elsewhere. Fifteen percent of the United States’ imports of processed, specific intermediates for transport equipment came from China in 2022 – second only to Mexico.

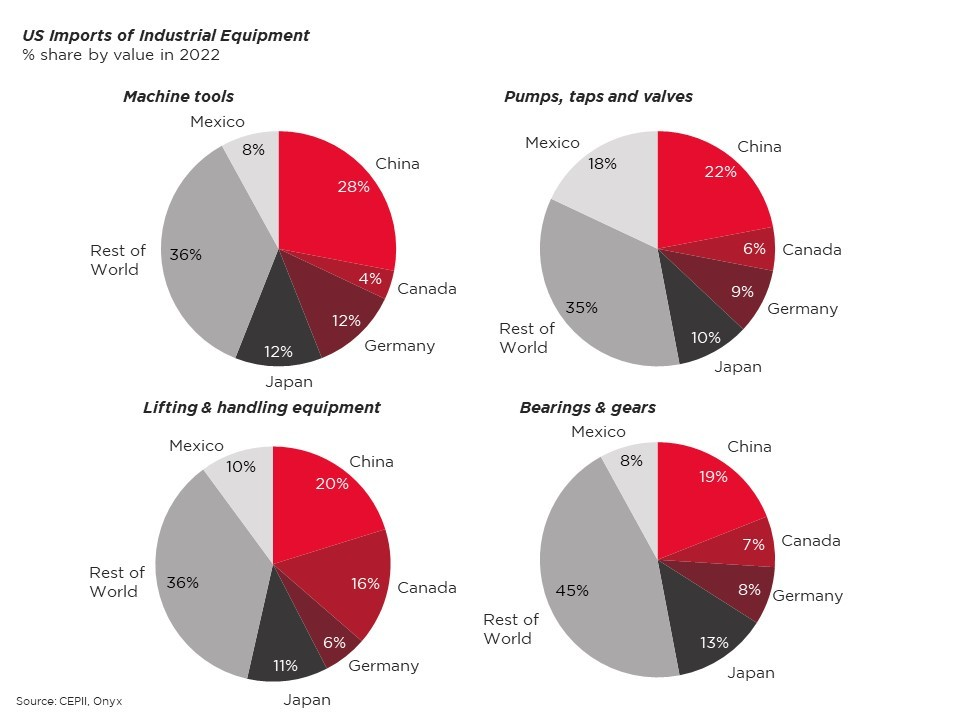

Transport equipment manufacturing would also suffer because it is especially capital-intensive, and China makes a large share the world’s capital goods. The US, like many countries, is very reliant on Chinese imports of the equipment necessary for industry including machine tools, valves, pumps, gears, and a variety of other industrial machinery. A significant increase in tariffs on China would both raise the cost of inputs while also introducing cost increases and shortages of equipment necessary for making cars and other manufactured goods. The result would be fewer cars and other goods produced in the US, and a likely hit to manufacturers’ margins.

Other industries would be less affected, and a few might even benefit. Textiles and apparel would potentially see an increase in sectoral GDP because apparel manufacturing competes directly with imports from China, is less reliant on Chinese inputs, and is less capital-intensive. However, textiles and apparel are among the smallest US industries, accounting for just 1% of US manufacturing by value added. On balance, the US economy may shrink relative to baseline if the US revoked PNTR with China because the worst-hit industries are also among the largest and employ the most workers.

Topics: North America, Asia, Trade

Written by Onyx Strategic Insights