Search our articles

With EU Elections, Russia and China Relations Come Into Focus

Key Insights:

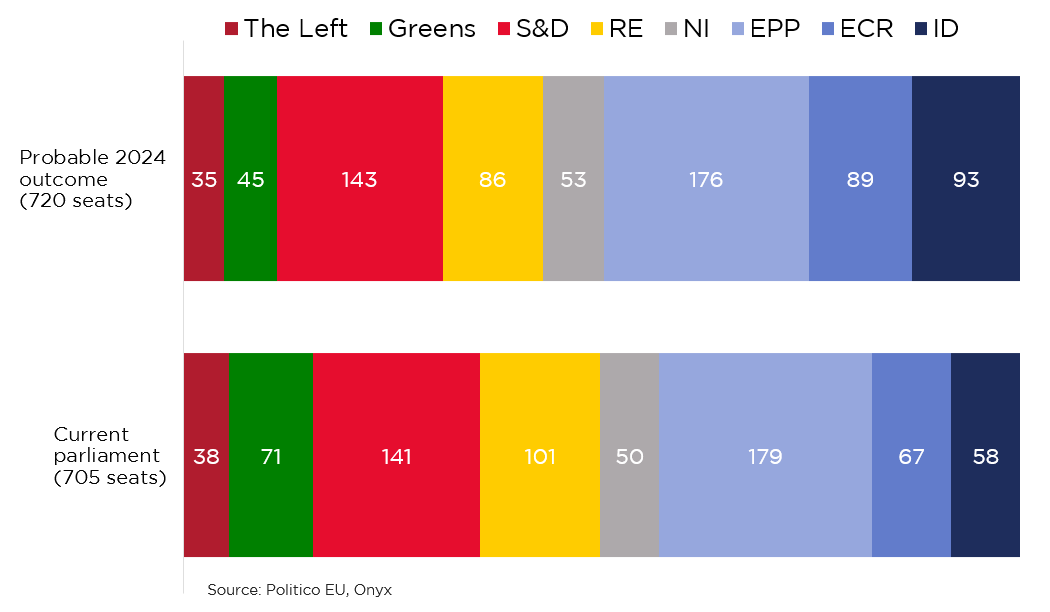

- What is happening: As European Union (EU) voters are set to elect a new European Parliament (EP) on June 6-9, Europe faces significant geopolitical pressures from Russia, China, and even the US. The internal composition of the EP is also set to shift as far-right parties are expected to gain significant vote share.

- Why it matters: Despite a rightward shift, overall EU relations with Russia and China will remain tense. EU concerns on China are wide-ranging and fundamental. Most of Europe sees Russia as a security threat that must be thwarted in Ukraine.

- What happens next: Companies should expect more trade and investment barriers between the EU and China, and additional EU sanctions on Russia. Targeted goods and sectors will include electric vehicles; wind turbines; batteries; critical raw materials – including potentially aluminum, steel, titanium, and other metals; pharmaceuticals; medical devices; and aerospace.

ANALYSIS

2024 European Parliament elections

Likely outcome at the time of writing: The centrist European People’s Party (EPP) and S&D grouping look poised to continue to dominate the EP. Ursula von der Leyen is favored to remain European Commission President. Polls suggest far-right parties will gain a louder voice in European policymaking and slow sustainability initiatives, but won’t significantly change the EU’s policy direction or geopolitical orientation.

EU-China relations

General direction: EU-China relations are set to become more confrontational, as concerns about China as an economic competitor and national security threat continue to grow. The variety of concerns and lack of progress in resolving them with Chinese leadership means there is little scope for improving relations in the medium term.

- On the economic front, leaders are worried about surging Chinese imports and their potential to undermine European industries. That is especially so in clean energy technologies and electric vehicles, where lower-cost Chinese imports may threaten the viability of Europe’s automotive sector.

- On the national security front, concerns center around China’s military support for Russia, investment in European infrastructure, human rights record, and Taiwan.

Upcoming EU policy actions: Expect an array of policies to curb Chinese imports and inbound investment, and limit China’s access to sensitive technologies. In the short term, the EU’s focus will be on several subsidy probes on electric vehicles, wind turbines, medical devices – and eventually other products. These will likely end in tariffs on Chinese car imports of at least 25%. Following US tariffs on a similar set of imports from China, the EU faces greater urgency to match US rates to prevent a flood of Chinese imports hitting the European market.

EU-Russia relations

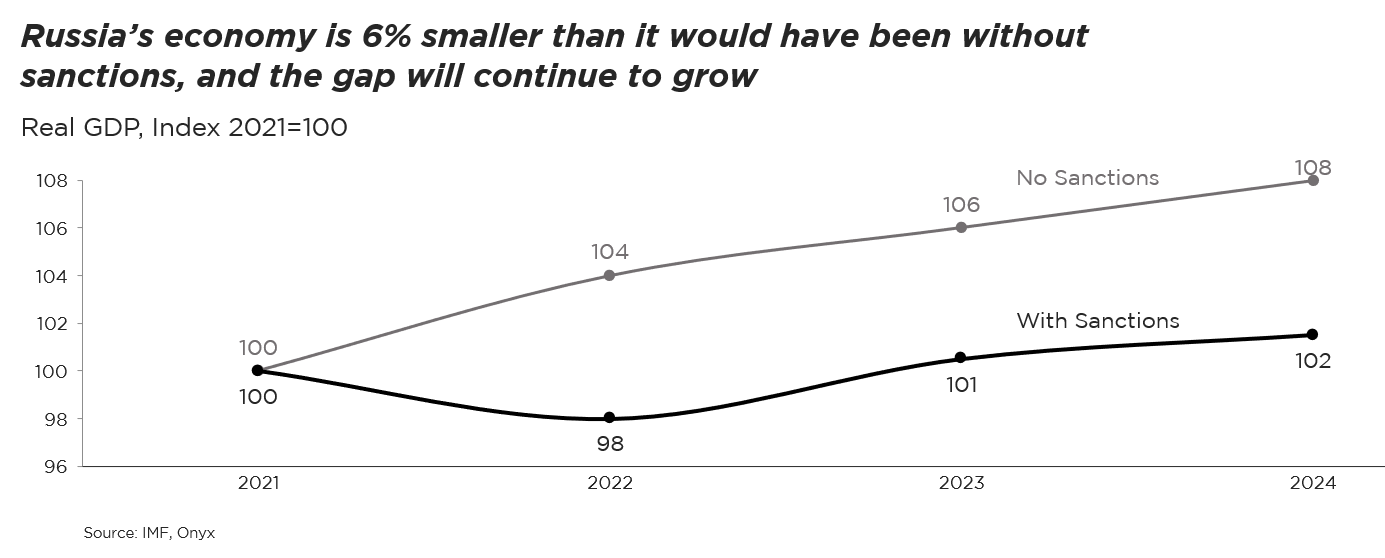

General direction: Most European leadership remains strongly supportive of Ukraine, where Europe seeks to prevent a Russian victory to discourage future attacks on EU countries or European NATO members. For that reason, EU and NATO support is unlikely to wane even if the United States reduces or withdraws its commitments towards Ukraine.

Next steps on Russia sanctions: Challenging Russia will entail maintenance and expansion of the EU’s sanctions regime, largely seen as successful. Expect additional measures to fight circumvention of banned imports through third countries – similar to the country of origin measures for diamonds and iron and steel. Those could include goods that already face bans but without a country of origin requirement to-date: liquefied natural gas (LNG), cement, wood, paper, synthetic rubber, plastics, and cosmetics. There also remains a moderate risk of import bans on other key Russian exports, such as aluminum, nickel, titanium, or fertilizers. While such measures would impose serious costs on European companies, EU leaders may target these goods in the event of further escalation with Russia.

Written by Onyx Strategic Insights