Search our articles

Continued Tough Stance on China, Regardless of Election Outcome

Key Insights:

- What is happening: The Biden administration is trying to carefully balance pursuing national security interests by encouraging US companies to diversify their supply chains while avoiding an economic downturn in China that could have a rippling negative impact on the United States.

- Why it matters: Companies in critical technology areas will see increased scrutiny on business dealings with China, especially around outbound investment and partnerships with Chinese companies regardless of where they are operating.

- What happens next: 2024 will continue to see piecemeal action taken against China, particularly around data transfers. The hawkish positioning of the US government towards China is likely to continue in 2025 in both the legislative and executive branches.

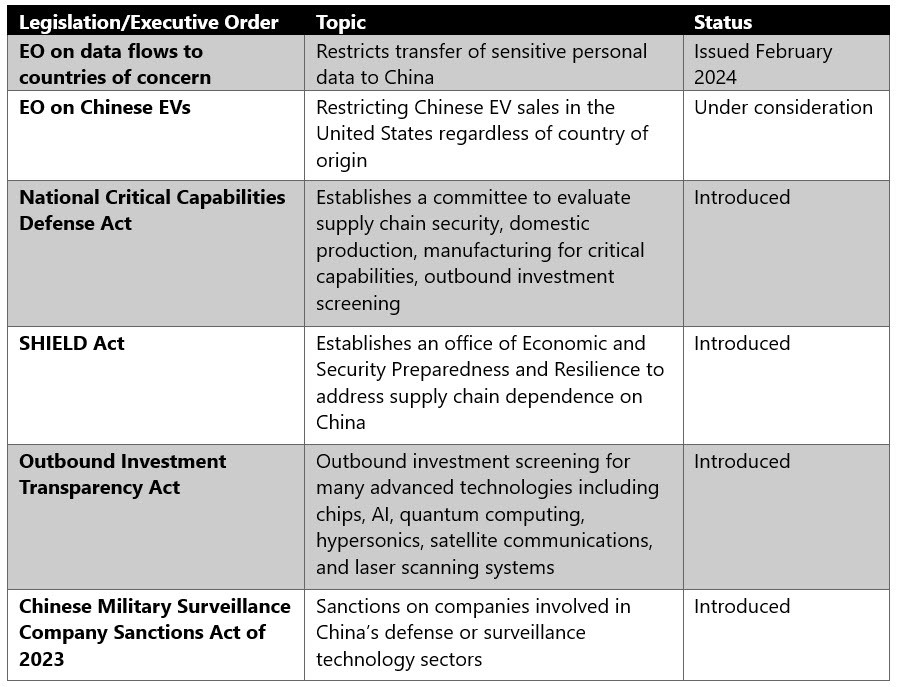

A wide range of legislation and executive orders have been proposed to address various challenges for the United States in its relationship with China, particularly around supply chains, outbound investment, and data. They include:

A key signpost in parsing US policy towards China is the work and policy recommendations of the US House Select Committee on the Chinese Communist Party (CCP), who recently released a report detailing 150 recommendations for congressional action to strengthen the US position. The Select Committee proposed bringing forth a comprehensive piece of legislation to address much of what was included in the report, but there was little support for doing so among the House more broadly. As a result, many of these policy proposals will instead be considered by individual committees and each proposal’s likelihood of passage into law must be considered on a case-by-case basis.

“Businesses should expect continued scrutiny of their operations in China and business relationships with Chinese companies, regardless of where those transactions take place.”

— Onyx Strategic Insights

While significant legislative proposals based on those policy recommendations are not likely in an election year, the Select Committee is highly bipartisan, and the hawkish tone of recent recommendations indicates that a more assertive US stance towards China is likely to continue. Businesses should expect continued scrutiny of their operations in China and business relationships with Chinese companies, regardless of where those transactions take place.

We expect to see continued progress on bipartisan policy areas, i.e. forced labor, sensitive and advanced technologies, and incremental tightening of restrictions on chips. Regardless of the winner in November, the next US president is likely to focus on bringing manufacturing jobs back to the United States, although avenues for doing so may differ. President Biden has focused on creating domestic job growth through green energy investments, while former President Trump has continued to promote the use of tariffs and other trade barriers to make manufacturing abroad less appealing for US firms.

However, as indicated by recent visits of high-level US officials to Beijing, there is concern about economic developments in China. The administration seems to be trying to balance containing Beijing geopolitically and economically while avoiding all-out economic warfare. There also seems to be concern about an economic downturn in China that could have a rippling negative impact on the United States. The Biden administration’s continued engagement through visits from officials at both the Secretary and working levels indicates that there is interest on both sides in avoiding serious economic disruption despite political rhetoric. Moving forward the performance of the Chinese economy will remain a key factor in the direction of US-China relations, especially on trade.

Topics: North America, Trade, Industrial, Politics

Written by Onyx Strategic Insights